Ekubo: The AMM Endgame

The ultimate Liquidity Layer for all things trading: how Ekubo rewrites the AMM playbook

Trading has always been crypto’s primary use case, and that hasn’t changed. Despite the rise of new narratives like DePIN, AI, or gaming, the lion’s share of volume, fees, and user activity still revolves around one thing: trading.

But while trading continues to dominate, most DEXs haven’t evolved past short-term incentives, inefficient designs, and tokens that capture little to no value.

Ekubo changes that.

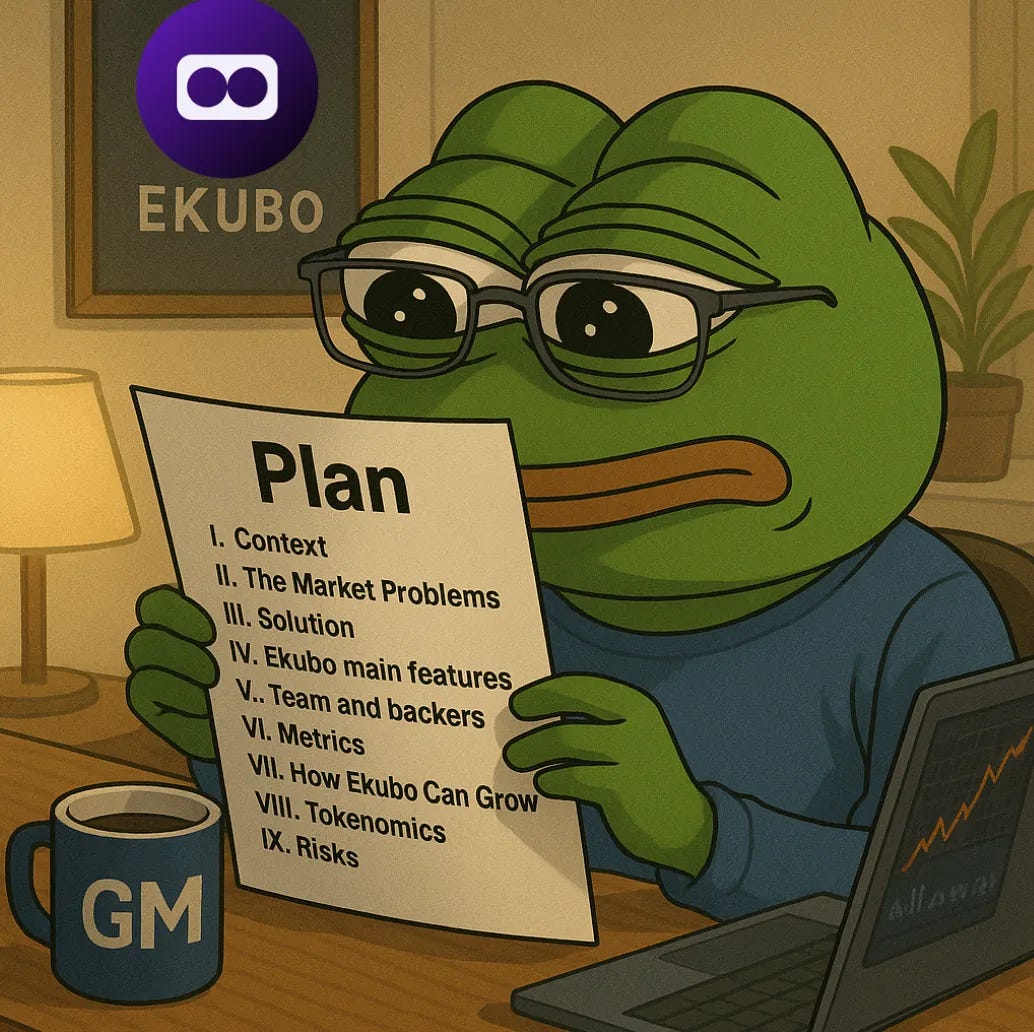

A protocol fully bootstrapped from day one, with no VC round, no shortcuts, and a laser focus on product. It delivers best-in-class infrastructure for trading, combining:

Ultra-concentrated liquidity

Gas-optimized execution

Permissionless extensions

Tokenomics that actually align with usage

And here’s where it gets powerful: Because Ekubo’s extensions are permissionless and plug into Ekubo’s own liquidity layer (arguably the most efficient in DeFi) builders can launch any DeFi primitive directly on top; with better UX, tighter integration, and more capital efficiency than launching on a standalone protocol or a legacy AMM. From DCA to launchpads, advanced order types, or options, if it involves trading, it can be built more efficiently on top of Ekubo.

And Ekubo is not just for builders, not at all: whether you're a trader, gem hunter, LP, or protocol dev, Ekubo delivers DeFi’s most powerful liquidity engine, with perfectly aligned incentives across all stakeholders.

I’ll focus this article on explaining how and why, following these sections:

I. Context

II. Market Problems

III. Solution

IV. Ekubo features

V. Team and backers

VI. Metrics

VII. How Ekubo Can Grow

VIII. Tokenomics

IX. Risks

I. Context

This article is already packed, and most readers probably don’t need a full refresher on how AMMs work.

So instead of bloating it with fundamentals, I’ve moved the key concepts into a standalone companion piece, where I cover the key concepts that underpin Ekubo:

What’s an AMM

Slippage

Impermanent Loss

Differences between AMM v1, v2, v3, v4

If you want a high-level refresher to better grasp why Ekubo is such a leap forward, start here.

For all the AMM OGs out there, let’s jump straight into Ekubo.

II. The Market Problems

AMMs have evolved, and v4 was built to solve two key problems:

Cut costs for both LPs and traders through a more efficient architecture

Enable permissionless extensions (hook), so any DeFi primitive can be built directly on top of a simple AMM pool

But tech alone isn’t the real bottleneck, market structure is.

Uniswap (and its clone PancakeSwap) still controls the lion’s share of EVM volume and TVL, 65-70% on most days. New names appear (like Fluid), but none has dented Uniswap’s network effects yet. When one project drives most AMM upgrades and optimizations, progress moves at the pace of a single roadmap. There’s a clear lack of innovation coming from projects outside of Uniswap.

Worse, token design across the board remains weak.

Take UNI: no revenue share, no buyback, no burn. Like most AMM tokens, it captures little to no value. Fees flow to LPs and to the protocol’s treasury/team, not to holders. And early fundraising was insider-heavy, with VCs getting in at deep discounts long before tokens hit the market. The upside? Already extracted.

The result is clear: a widening gap between protocol growth and tokenholder returns.

Ekubo is perfectly positioned to fix that.

III. Solution

Ekubo is a DEX built with a product-first philosophy, centered around two core principles: delivering the most efficient liquidity layer for trading, and ensuring that protocol growth is directly tied to token holders.

Its architecture is designed for performance at every level. Ekubo pushes capital efficiency to its limits through ultra-concentrated liquidity, a singleton contract system, and a till-based execution model that minimizes redundant token transfers and gas usage.

Beyond architecture, Ekubo offers a high level of flexibility for liquidity providers and developers. With permissionless extensions, anyone can build and integrate custom onchain strategies, or even create entirely new pool logic, natively within the protocol.

This design turns Ekubo into a liquidity infrastructure layer for all of DeFi, efficient, composable, and adaptable. Every optimization is made with a clear set of goals: improving execution for traders, maximizing yield for LPs, and ensuring that value created at the protocol level accrues to token holders.

And this vision is backed by deep technical credibility. Moody, Ekubo’s founder, was a core contributor to Uniswap v3, wrote much of its codebase, and led the architecture of v4. Ekubo builds on that foundation, refining and extending it where it matters most.

By combining four foundational pillars, Ekubo sets a new benchmark for AMM design:

Gas-efficient architecture, through the singleton architecture and till pattern

Capital efficiency, via precise tick sizing and liquidity concentration

Modularity, enabled by fully permissionless extensions

Token alignment, with protocol-level withdrawal fees and DAO-managed buybacks

Let’s explore each of these components in detail.

IV. Ekubo main features

Singleton

Ekubo uses a singleton contract architecture. In traditional AMMs (basically everything pre–Uniswap v4), each liquidity pool lives in its own smart contract. That means duplicating the same logic again and again, and paying gas for it every time.

Ekubo does it differently.

With singleton architecture, all pools exist within a single smart contract. Just one. That’s where the term “singleton” comes from.

This unlocks several major benefits:

No need to redeploy shared logic for each new pool

Pool creation is ~99% cheaper in gas

Swaps cost ~50% less thanks to reduced storage writes and the absence of token transfers between pools in separate contracts.

Easier aggregation and internal liquidity routing

Better pricing for multi-hop swaps, since intermediate steps are cheaper

In short, the singleton design makes Ekubo cheaper, faster, and more efficient for LPs, traders, and devs.

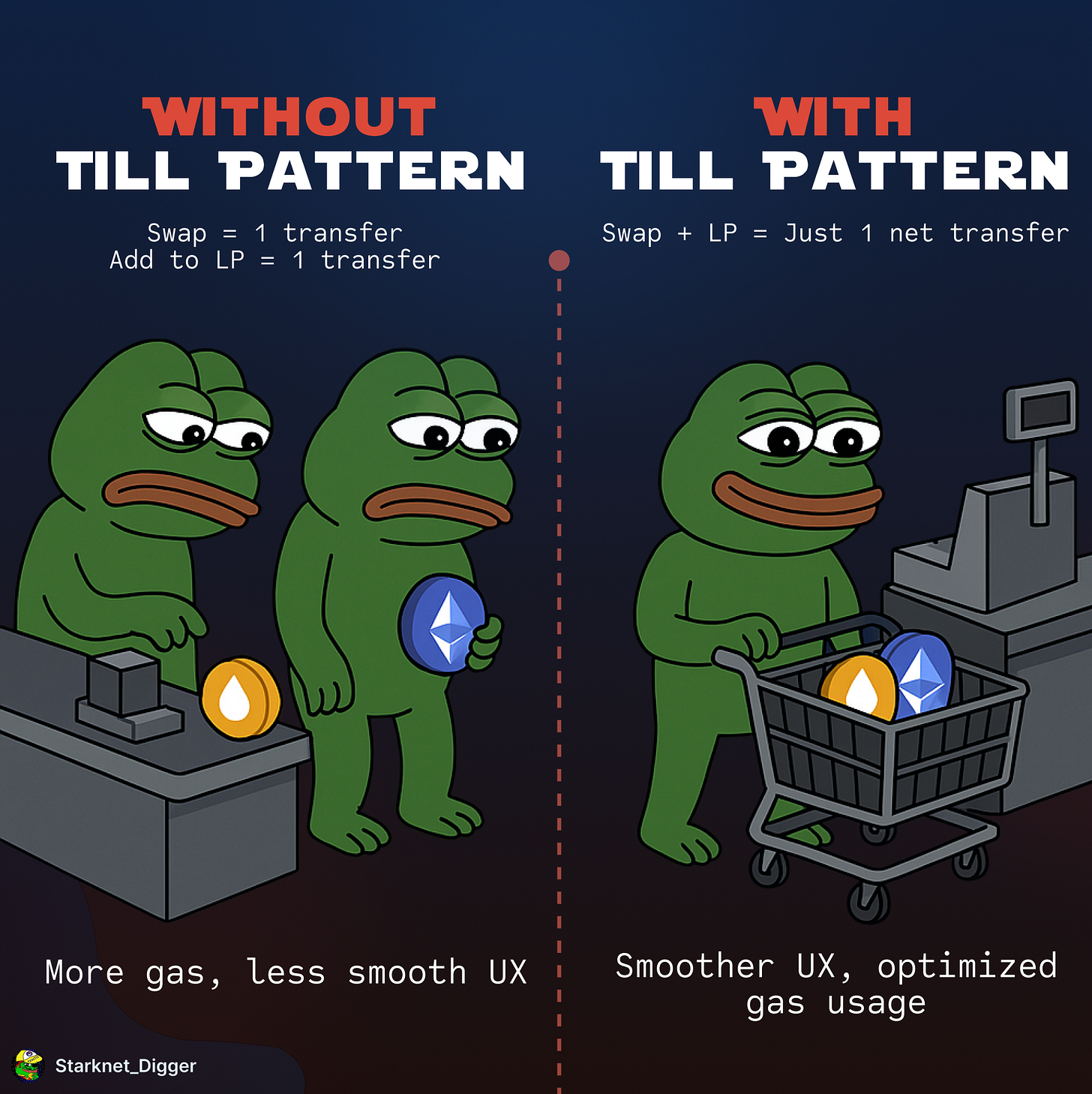

Till Patern

Ekubo uses the “till pattern”, a mechanism where token transfers aren't processed incrementally with each interaction, but instead batched and finalized only at the end of the transaction.

Think of it like going to the supermarket: you grab everything you need (swaps, LP actions, position updates) and only pay once when you check out. Ekubo works the same way. Instead of triggering a transfer after each operation, it defers all token movements until the full transaction is complete, then handles them in a single, efficient step. This reduces overhead, eliminates unnecessary back-and-forth, and significantly lowers gas costs.

For aggregators, the benefits are even greater: they can leave tokens inside Ekubo throughout a series of actions, batch everything in one flow, and execute only when necessary. This improves composability and drives down execution costs.

So the till pattern unlocks several key advantages:

Fewer token transfers mean cheaper, faster transactions.

Capital flows are more efficient, benefiting LPs, traders, and aggregators alike.

Perhaps most importantly, Ekubo supports safe reentrancy. While most protocols restrict nested calls to prevent exploits, Ekubo enables secure, modular interactions (even across contracts) without introducing attack vectors.

As a result, smart contracts can interact with Ekubo freely, without being constrained by rigid transaction logic. Aggregators can chain multiple swaps or liquidity operations in a single call, while token transfers are only executed when strictly necessary: minimizing gas usage and improving UX.

In short: batch logic first, settle later, that’s the power of the till pattern.

By combining the till pattern with a singleton design, Ekubo achieves ultra-high gas efficiency; likely the AMM delivering the best execution, net of gas.

Ultra-Concentrated Liquidity

Ekubo pushes concentrated liquidity to its logical extreme. While most AMMs offer basic implementations, Ekubo introduces hyper-precision with tick sizes as small as 1/100th of a basis point (0.000001), enabling an order of magnitude more precision than other protocols, and even rivaling the pricing accuracy of centralized exchanges.

In this context, a tick refers to the smallest possible price increment in a concentrated liquidity AMM like Ekubo.

Smaller tick sizes allow for:

Extremely precise liquidity placement

Tighter spreads, enabling more competitive markets

Lower slippage, giving traders better execution

The result: LPs earn more, traders get better prices, and the entire system operates more efficiently.

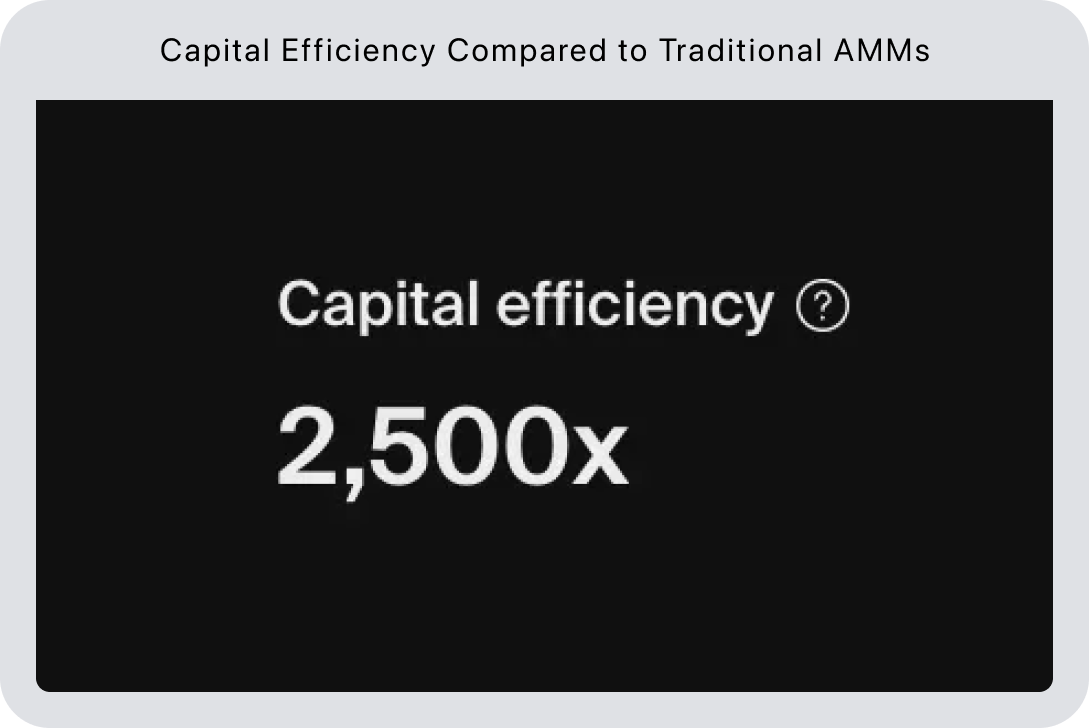

In practical terms, $1,000 of liquidity on Ekubo can perform as well as $100,000 on another AMM, thanks to the extreme concentration made possible by its fine-grained tick architecture. So LPs and traders can do more with less. Here’s a concrete example of the benefits unlocked by such small tick sizes.

Worth noting: anyone can also create v2-style full-range positions for passive LPing. Unlike concentrated liquidity, which typically requires active management, full-range positions offer simpler exposure and no need to monitor price movements.

To do so, LPs just need to set min range = 0 and max range = very, very high.

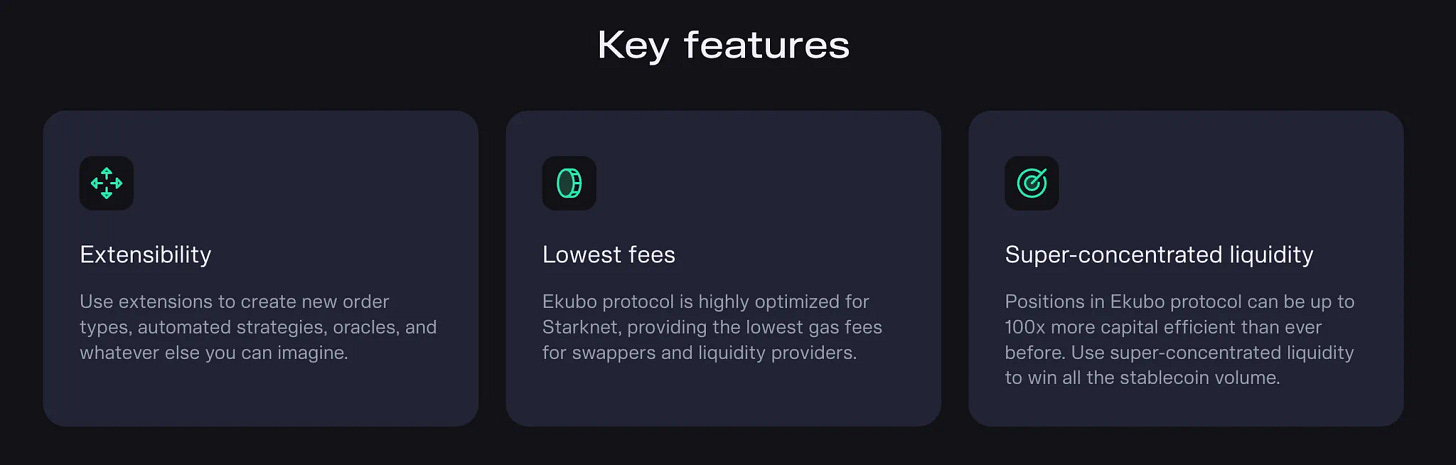

Extension

One of Ekubo’s most powerful features is its extension system, which enables third-party developers to build entirely new types of pools in a fully permissionless way. These extensions embed custom logic directly into the core of the protocol, while remaining fully compatible with Ekubo’s broader ecosystem of aggregators, interfaces, and tooling.

Everything can be customized: before, during, and after a transaction. Developers can attach extensions to pool interactions, modify behavior at key execution points, or capture onchain data. This unlocks a new level of flexibility: pricing curves can be redefined, custom oracles can be added, external protocols can be integrated, and privacy-preserving logic can be embedded; all within Ekubo’s unified architecture.

The result is a radically improved UX for both LPs and traders, plus greater control over how LP capital behaves, with pools configurable to match precise strategies or adapt to evolving market dynamics.

Three extensions already live in the Ekubo ecosystem showcase this flexibility:

Limit Orders: Users can place ultra-precise onchain limit orders, often more accurate than what’s possible on most CEXs, thanks to Ekubo’s highly concentrated liquidity. These trades are executed entirely onchain, with no hidden fees or third-party dependencies. With this extension, you can set up buy or sell orders in advance, at a very specific price, and let the system handle execution automatically.

TWAMM Orders (DCA): Ideal for large trades or gradual accumulation, TWAMM extensions allow users to execute long-duration orders fully onchain, minimizing slippage and market impact. This enables a native DCA experience: you can gradually buy or sell an asset over time, without needing to manually manage multiple orders. This TWAMM extension can be particularly powerful for DAOs.

Oracle Extensions: Provide a reliable time-weighted average price (TWAP) by averaging pool prices over a defined period. This manipulation-resistant design makes it significantly harder to exploit prices compared to external or spot oracles.

Note that all these extensions are integrated into Ekubo without any fragmentation. Users can easily use them, and when swapping via the Ekubo UI, the router takes all available pools into account to deliver the best price execution.

The potential with Extensions is infinite, the only bottleneck now is our monkey brains. To give you a sense of what's possible, here are a few examples of protocols developers could rebuild on top of Ekubo, with better optimization, UX and gas efficiency than their standalone versions:

A Pump.fun-style launchpad; actually, Moody is already cooking one, and the MVP is expected for mid/late summer

A Fluid-style protocol

A perp trading app similar to Infinity Pools

And for the privacy maxis; Ekubo has open-sourced the first iteration of privacy pools on Starknet. Think Tornado Cash, but with the ability to prove your funds came from a specific deposit set, without revealing which one. More here.

In short, with Ekubo extensions, what once required an entirely separate protocol can now be built directly on top of Ekubo, instantly benefiting from its shared liquidity, routing infrastructure, UI integrations, and the broader ecosystem.

Withdrawal Fees

Ekubo introduces a subtle but powerful mechanism to balance incentives in liquidity provision: withdrawal fees. It’s simple in principle, yet impactful in practice.

When you remove liquidity from a pool on Ekubo, you pay a fee equal to the pool’s swap fee. That fee is taken directly from your principal, not from your earned fees. It’s protocol-level, enforced on every withdrawal, and it changes the game for liquidity behavior.

In simple terms, if you create a pool with a 0.3% swap fee and later remove $10,000 of liquidity, you’ll be charged 0.3% on exit, which equals $30. This mechanism discourages short-term, opportunistic strategies, like just-In-Time (JIT) liquidity providers (those who deposit liquidity right before a large trade to collect fees, and instantly pull out) from exploiting passive LPs who stay exposed to price risk.

Here’s how it plays out in practice:

A mercenary LP drops $1M into a pool with 0.05% fee, hoping to snipe a juicy arb.

They withdraw within the same block.

Ekubo charges them $500 (0.05%); exactly the same as what they’d hope to earn.

Net result: zero gain, minus gas.

It’s not banned, but it’s economically disincentivized.

On the flip side, long-term LPs aren’t punished. The longer you stay, the more you earn in fees, making the withdrawal cost negligible over time. And thanks to Ekubo’s ultra-efficient tick architecture, you need less capital to earn more, which makes that fee even smaller in relative terms.

Note that zero-fee pools are also possible, this is what notably enables the creation of TWAMM (DCA) or limit orders extension without introducing additional fees.

So what does this model unlock?

Fewer liquidity mercenaries: behavior that hurts passive LPs becomes less profitable.

Better fee alignment: if you want to charge a 0.3% swap fee to traders, be prepared to pay 0.3% to leave.

Incentives that favor deep, sticky liquidity: The design naturally rewards concentrated, low-fee, and passive liquidity, improving execution for traders.

Protocol revenue with purpose: Withdrawal fees are accumulated in the core and can be withdrawn by the core owner, which, in Ekubo’s case, is the governance. Currently, 100% of these fees are directed toward $EKUBO buybacks.

As of June 2025, over $1M has already been collected and used to support the token economy with a buyback of the token (you can find all token buyback metrics here). That’s value captured without adding interface fees, token taxes, or artificial inflation.

Ekubo’s DAO

I know, it’s rare. But in Ekubo’s case, the DAO is not just a meme.

While Ekubo, Inc., the company led by Moody, is the main contributor behind the protocol (more on that in Part V), it does not control it. Ownership of Ekubo’s smart contracts has been fully transferred to the DAO, which now governs the protocol entirely onchain.

Ekubo, Inc. is just one participant in the DAO, and despite holding significant voting power, it does not have unilateral control. In fact, here’s a recent example of a proposal that did not pass, even though Ekubo, Inc. voted in favor.

To date, over 40% of all governance proposals have come directly from the community, not from Ekubo, Inc. Anyone with at least 100,000 EKUBO tokens delegated to their address can submit a proposal. Governance is open, active, and community-driven.

This structure gives Ekubo token holders full responsibility over the protocol’s direction, including:

Managing and upgrading the core smart contracts; adding a layer of security, since most contracts are upgradable on Starknet (whereas on Ethereum, most of the core and extension contracts developed by Ekubo Inc are immutable), but only through a DAO vote

Controlling the Ekubo treasury; including funds dedicated to growing the social layer

Deciding how buyback funds are allocated; whether through burns, liquidity incentives, staking rewards, or other programs

If you hold EKUBO and want to help shape the protocol’s future, join the DAO discussions on Discord, notably in the Town Hall channel.

At this point, you might ask: this all sounds impressive on paper, but in a saturated AMM landscape dominated by Uniswap, what truly gives Ekubo an edge?

The answer is simple: Ekubo doesn’t just replicate Uniswap v4’s architecture, it pushes it further. It aggressively optimizes every layer of the stack and introduces new, native features to deliver a faster, leaner, and more flexible AMM.

Here’s how Ekubo outperforms other AMMs in practice:

Unmatched gas efficiency: Ekubo’s contracts are rigorously optimized, making it 20–30% cheaper to use than leading AMMs, across swaps, LPing, and pool creation. Don’t trust, verify: run identical operations on Ekubo and Uniswap, and check the gas usage yourself.

Hyper-precise liquidity deployment: Ekubo uses tick sizes 100x smaller than Uniswap v3/v4, enabling LPs to concentrate liquidity with surgical precision. The result? Tighter spreads, better prices for traders, and higher fee efficiency, even with smaller capital.

Feature-rich by default: What’s an external plugin or separate protocol elsewhere is native in Ekubo. Limit orders, TWAMM (DCA), and Oracle pools are all composable, onchain, and deeply integrated into Ekubo’s core logic.

Designed for Aggregators: Ekubo’s efficiency directly benefits aggregators, where most real volume flows.

5. Relentless shipping: the team continues to ship at an aggressive pace: One of the first DeFi protocols to deploy 1-click swap + LP on Ethereum - constant low-level improvements and gas optimizations - created and open-sourced the first iteration of a Privacy Pools on Starknet

6. A Token that actually captures value: most AMM tokens are deadweight, no revenue share, no burn, no buybacks, just governance theater and VC exit liquidity. Ekubo flips the script:

Fair launch, no VCs, full float from day one

100% of withdrawal fees go to the DAO

The DAO uses those fees to buy back $EKUBO on the open market

This creates direct alignment between protocol usage and token holders. More on this in the Tokenomics section (IX).

V. Team and backers

Ekubo is now governed by a DAO, no more single-entity control.

But who kickstarted the whole thing? Who’s still shipping? And how’s the DAO evolving?

The builder behind the protocol

Ekubo, Inc. is the company that created and still maintains the protocol. It’s led by Moody Salem, a Ethereum OG and one of the most prolific minds behind AMM infrastructure.

His reputation for clean, security-minded code is echoed by fellow OGs; see, for instance, Harikrishna’s endorsement.

Aside from Moody, Ekubo, Inc. is intentionally small and engineering-focused, and remains the protocol’s main contributor. You can find a brief overview of its mandate, operating budget, and no-sell pledge in this DAO grant document.

Transition toward a multi-team ecosystem

The vision?

A slim, expert core at the center, and a growing ring of ecosystem contributors over time.

First steps: open up marketing and BD. Several community groups have already signaled interest in taking on those responsibilities.

This contributor model mirrors the protocol’s tokenomics design: → keep protocol maintenance tight, → push autonomy to the edges over time.

In terms of backers, there are no backers per se, but Ekubo is the project that received the largest Catalyst grant from the Starknet Foundation; 6M STRK tokens, compared to 3M STRK for the second-largest recipient.

Moody also proposed a strategic partnership to Uniswap: a $12M investment (3M UNI) into Ekubo, valuing the protocol at $60M. The Uniswap community approved it, but in the end, Ekubo chose not to move forward.

Indirectly backed by the Starknet Foundation. Approved by Uniswap. Probably nothing.

VI. Metrics

1. On Starknet

At launch, Ekubo shared the field with several AMMs. Twelve months later, it commands over 60% of Starknet’s AMM TVL and captures most of the trading volume, either directly or via aggregators like AVNU and Fibrous.

TVL distribution before Ekubo launched vs. after, snapshot from June 11, 2025.

A total destruction of all competitors. And that’s despite:

mySwap and JediSwap both being v3 AMMs

SithSwap being optimized for stablepools (USDC/USDT, wETH/ETH, etc.)

Ekubo is so optimized that most of swaps routed by aggregators on Starknet go through its pools, and this was already true when its TVL was still small.

Back in September 2023, I wrote:

“As the only UniV4-style AMM on Starknet, it is likely that Ekubo will attract TVL from other AMMs in the coming weeks.”

That’s exactly what happened.

2. On EVM

While its EVM expansion is still in its early phase, and currently limited to Ethereum, Ekubo is already showing very promising signs.

As of June 11th, the number of new Ekubo users keeps climbing, while volume has seen exponential growth in recent weeks.

With only ~$4M in TVL (now $7m), Ekubo already ranks among the top 6 DEXs on Ethereum by volume, and Ekubo has by far the highest Volume/TVL ratio among all top DEXs.

(Screenshot from May 24th; unfortunately, DeFiLlama has since removed the Volume/TVL ratio comparison, but the numbers look even better now for Ekubo, with a ratio above 20 on some days)

This ratio (20) means that every $1 of TVL on Ekubo generates $20 in trading volume per day 🤯

3. Globally

Ekubo has already generated over $1M in revenue since launch. And that's just on Starknet. With its EVM expansion now happening, I expect that number to grow rapidly:

In short: Ekubo is the liquidity monopoly on Starknet; and the most capital-efficient DEX on Ethereum.

VII. How Ekubo Can Grow

As this analysis shows, Ekubo can be seen as the best liquidity infrastructure on the market. Since trading is crypto’s biggest use case and depends on deep, efficient liquidity, Ekubo is perfectly positioned to scale quickly. Several factors could accelerate its growth.

1. Starknet Growth

This is a key point. As outlined in Section VI: Metrics, Ekubo has reached such dominance on Starknet, in both TVL and capital efficiency, that it now passively captures upside from the network’s growth.

In terms of:

Liquidity: Ekubo accounts for over 60% of all AMM liquidity on Starknet.

Volume: Ekubo is extremely optimized and offers unmatched capital efficiency.

As such, most of DEX aggregators volume on Starknet go through Ekubo pools.

AVNU, the leading DEX aggregator, which powers most of the trading UX across Starknet, is deeply integrated into the ecosystem, and a major part of its liquidity power comes from Ekubo. See graphic below showing how AVNU is the invisible engine behind most trading flows.

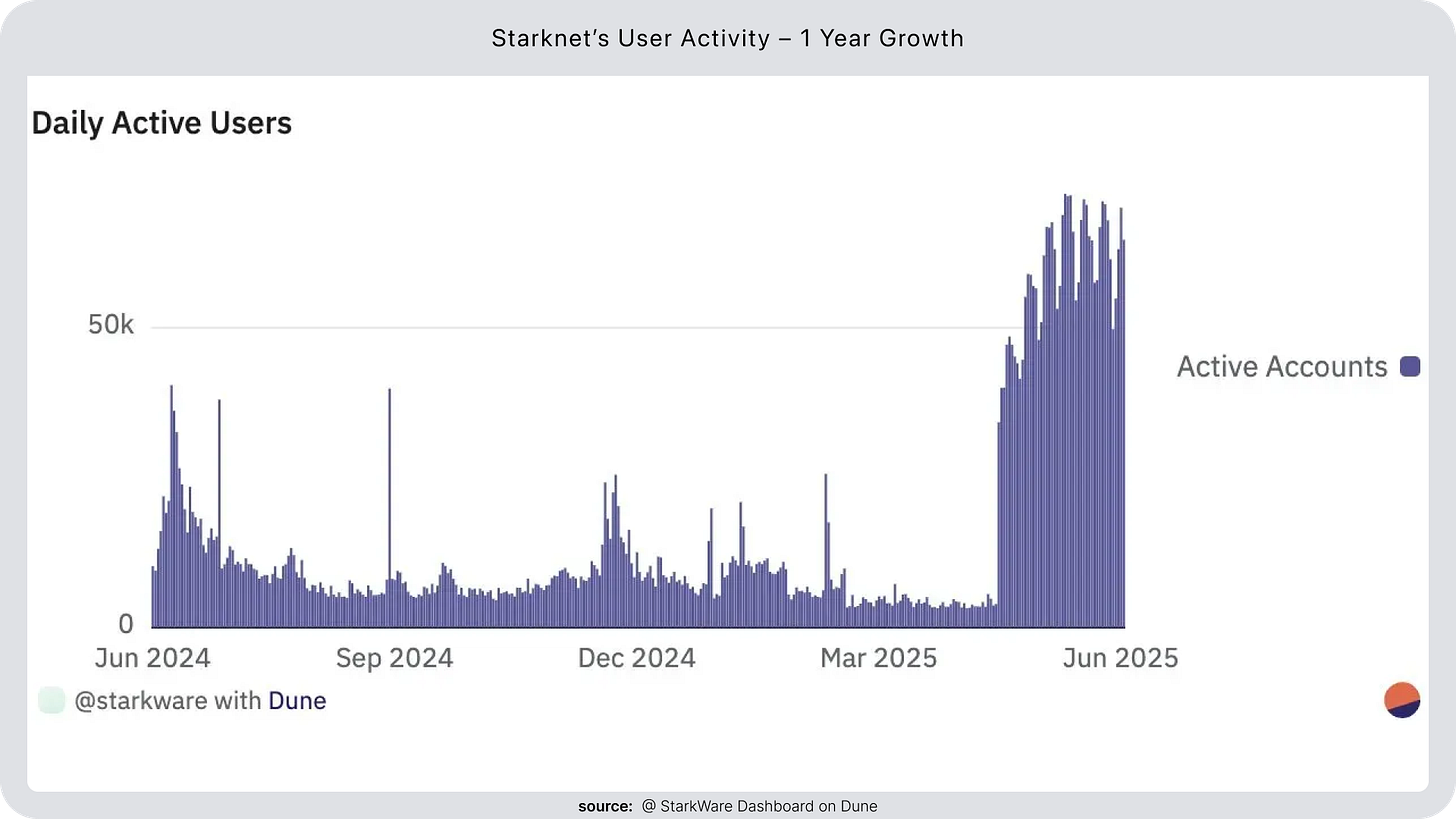

So as Starknet grows, and I truly believe it has now found its PMF and is entering a phase of rapid adoption, Ekubo will continue to benefit passively.

Here are some signs of the Starknet revival:

After nearly a year of low activity, users are coming back onchain.

Starknet is now a top 5 Rollup by TVL, and one of the most active, consistently handling between 3 and 10 TPS daily.

And this resurgence is only just beginning; several major catalysts are lined up:

Lombard launch - the leading BTC LST coming to Starknet

Extended - a major perp DEX launching on Starknet L2, offering the same features as Hyperliquid/Paradex

Rosettanet - EVM wallet compatibility

Two major interoperability protocols integrating Starknet in Q3/Q4 2025

Bitcoin staking

BTCfi campaign launch by the Starknet Foundation

All of this activity will flow through Starknet’s DeFi stack, and as the dominant liquidity layer, Ekubo will passively capture the upside.

2. Expansion into the EVM Ecosystem (and also CairoVM!)

Ekubo has already established strong metrics on Ethereum L1, and that launch is only phase one. Because the codebase is now EVM-compatible, the protocol can be deployed to any major EVM chains with minimal effort; Base, Arbitrum, BSC, HyperEVM (Hyperliquid), Sonic, Monad, and more. In fact, some teams are already courting Ekubo for a launch; Sonic’s core developer Andre Cronje publicly invited the project to do that on Sonic 😉

Bottom line: Ekubo can scale its market share horizontally across chains whenever the DAO decides the timing is right.

On Starknet, Ekubo is written in Cairo; the rise of Cairo-native chains built on the Starknet Stack widens the runway further. Paradex (perp DEX), Agent Forge (AI marketplace), Eara (RWA infrastructure) and StarkPay (payments chain) are already building Cairo-based chains.

As that ecosystem expands, Ekubo’s Cairo code can be redeployed to multiple L2s just as easily as its Solidity version moves within the EVM world.

3. Deep Liquidity & Efficiency: A Builder Magnet

Thanks to its superiority over other AMMs in terms of gas and liquidity efficiency, Ekubo is set to continuously attract more TVL. And as it does, a flywheel effect kicks in.

Ekubo is already shaping up to be the best trading liquidity infrastructure, and thanks to extensions, anyone can build on top to create advanced DeFi use cases, tapping into its deep liquidity and unmatched efficiency.

A few examples of what can be built using Ekubo’s extension framework:

AMM x Money Market hybrid → Fluid like use case

Max leverage, no liquidation → Infinity Pools like use case

A better version of Pumpfun (currently in the works, led by Moody)

On Ekubo itself already available:

DCA (TWAMM)

Limit orders

Oracle pools

Private pool initiative on Starknet (not production ready)

My view: If Ekubo continues to attract liquidity across EVM chains, it will establish itself as the go-to AMM infrastructure for advanced DeFi; the foundation where developers build any use case that demands deep, capital-efficient liquidity. And the beauty of it? All these apps will be natively integrated into Ekubo and composable by design.

4. BTCFI Growth

While fully trustless BTC DeFi isn’t here yet (please OP_CAT come back 😿), BTCFI is already growing. One of the main use cases is onchain BTC trading and liquidity providing.

Crucially, Ekubo is:

The most efficient AMMs out there

The best infra layer for traders and LPs

So it’s perfectly placed to benefit from the BTCFI narrative.

Even more bullish? The chain where Ekubo dominates (Starknet) is actively working to become Bitcoin’s execution layer, making it the most compelling infrastructure to bring BTC at scale.

One example: Lombard, the leading BTC LST, is coming to Starknet, and Ekubo will be the go-to place to provide liquidity and trade it.

5. DEX Growth vs. CEX

As CEX dominance declines in favor of DEXs, Ekubo is naturally set to benefit from this onchain trader migration.

TL;DR

Ekubo is perfectly positioned to benefit, both passively and actively:

Ride Starknet’s accelerating growth.

Expand rapidly across EVM (and Cairo) chains.

Leverage extensions to draw builders and TVL.

Capture the emerging BTCFi wave.

Benefit from the long-term shift of volume from CEXs to DEXs.

By deploying across multiple chains, Ekubo diversifies risk while massively scaling its potential.

And perhaps the most powerful aspect of Ekubo’s positioning: once it has accumulated enough TVL, it no longer needs to acquire users directly, most of the volume flows passively through aggregators.

All it needs is a minimum amount of liquidity on each new chain, aggregator integration… and the passive flywheel takes over.

VIII. Tokenomics

Recently, I came across a Binance Research article explaining what they believe makes good tokenomics: Sustainable Tokenomics: Questions Every Founder Should Think About.

This article comes in the wake of the collapse of high-valuation, low-float tokens that primarily benefit VCs and market makers, at the expense of retail users like us. What surprised me most was that every single criterion listed in the article had already been implemented, and optimized by Ekubo well before the tokenomics backlash and the release of this article.

To establish a healthy token economy, we posit that there are four key design objectives:

Fair Distribution Of Token Supply

Sustainable Supply Emissions

Distinct Demand For The Token

Active and Decentralized Governance

Other considerations beyond tokenomics that may have a bearing on a token's performance:

Valuation on launch

Transparency over team vestings/sales

Let’s go through each point, one by one.

1. Fair Distribution

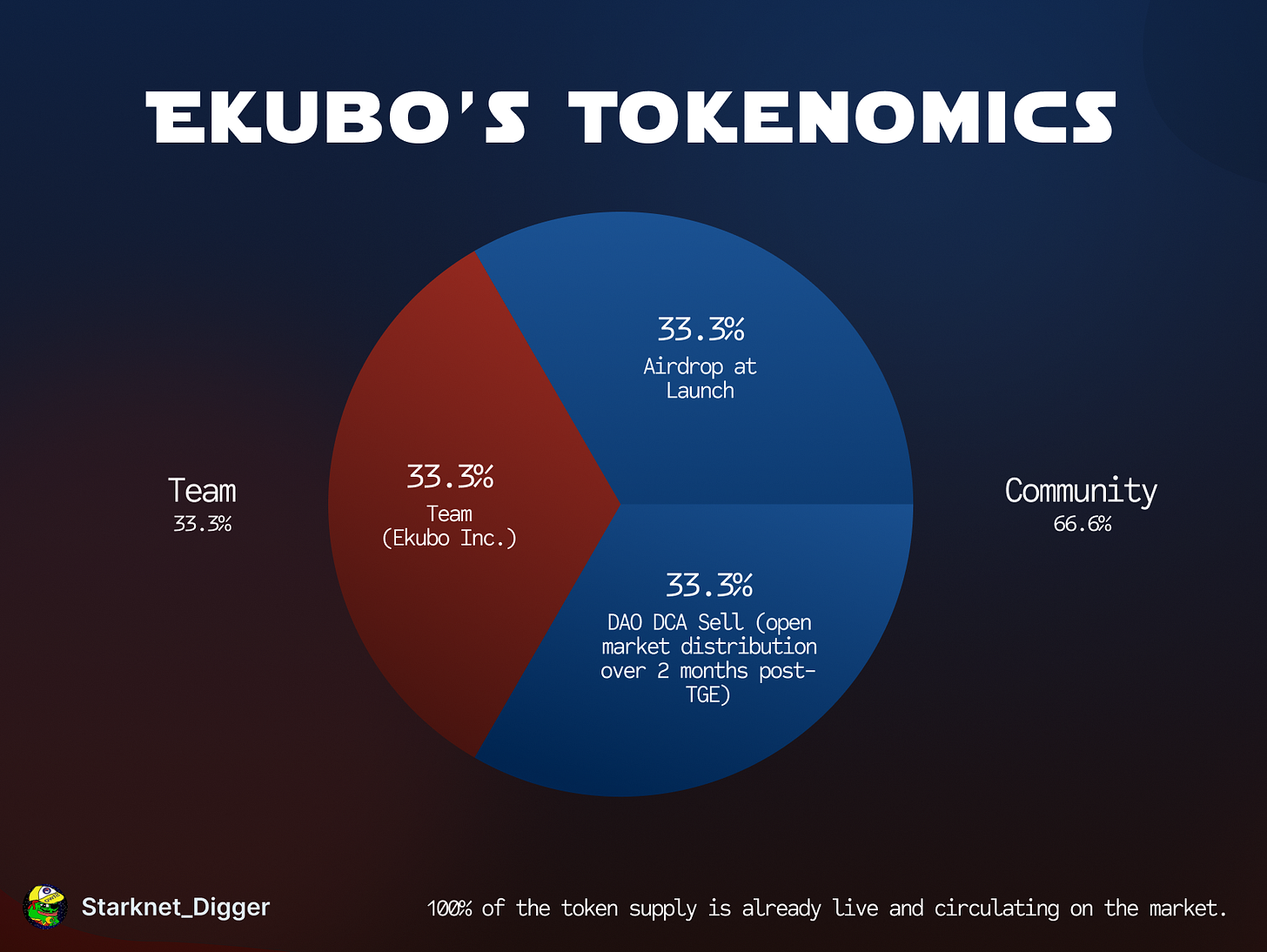

Ekubo directly distributed 66% of the supply to the community:

33.33% was airdropped to early users of the protocol

33.33% was sold via DCA orders on the open market on Starknet over a two-month period (from 5/24/24 to 7/23/24), allowing the protocol to bootstrap its treasury and giving everyone a chance to buy the token early and at low valuation.

What’s even more powerful about this mechanism and duration is that it not only let people buy Ekubo at a low valuation, but also allowed airdrop hunters to exit early at low price, creating a clean separation between long-term believers and short-term farmers.

The remaining 33.33% was allocated to the Ekubo core team and current main contributor, Ekubo Inc. The team has pledged not to sell any of these tokens as long as they’re building and employed by the DAO:

We also commit to never selling any of the allocated 33.3% of EKUBO tokens from the company treasury for as long as the company exists. This means the company will always be incentive aligned with the success of the protocol. Source

Ekubo Inc. is currently contracted with the DAO until at least July 28, 2026.

We are requesting a grant of ~$1.5M to sustain the company in this role for at least the next 2 years without additional funding. This should be the only grant Ekubo, Inc. ever requests from the DAO: in the future, the company should be sustained by revenue from the one-third of total EKUBO tokens it holds.

Source

So we can assume that this 33% chunk will not be moving until at least mid-2026 (and likely longer).

Ekubo tokenomics keep the complexity away and are majority-community-owned.

2. Sustainable Supply Emissions

Even simpler than the previous point: all tokens are already in circulation. There is 0 inflation, no vesting. Ekubo is one of the few protocols with a MC equals FDV.

3. Distinct Demand For The Token - Product is integral to long-term token performance

Ekubo token holders are directly aligned with protocol growth. Ekubo collects revenue through withdrawal fees; every time a liquidity provider exits a pool, they pay a fee equal to the pool’s fee, applied to the entire position.

These fees are used to buy back EKUBO tokens. As of June 11, 2025, the DAO has bought back over 195,000 EKUBO (~2% of total supply), or about $900k worth. This is all trackable in real time here.

Since launch, Ekubo has generated over $1M in revenue.

Given the 5 growth factors mentioned in Section VII (How Ekubo Can Grow), I truly believe Ekubo’s TVL is set to keep growing. More TVL = better execution for traders = more routing through Ekubo = better LP APR = even more TVL. And more TVL means more revenue and token buyback. Especially since LPs need to be active in concentrated liquidity pools.

What will the protocol do with the bought-back tokens? That’s up to the DAO. Possible options include:

Burn the repurchased tokens

Distribute them to stakers, especially active governance participants

Use them to incentivize additional TVL

Again, this is entirely up to the DAO; Ekubo holders control it, as the token grants governance rights. At the moment, part of the bought-back supply is being allocated to incentivize liquidity on Ethereum L1. You can learn more about this here.

Worth nothing, the token is also used across the Starknet ecosystem:

You can also pay gas fees with it using Argent wallet; so you can interact on the whole Starknet ecosystem by paying your gas fees with Ekubo

4. Active and Decentralized Governance

Ekubo DAO is currently one of the most active DAOs in DeFi. Since launch 31 proposals in total; 29 passed, 2 rejected. Of those 17 were from Ekubo Inc., and 14 were community-driven.

Notable proposals include:

Currently, 62% of the EKUBO supply is staked, making it eligible for governance participation.

If you want to participate in governance and follow in real-time all proposals, here is a TG bot informing you when a proposal is launched and active.

5. Low valuation on launch

The two-month DCA sale (May 24 to July 23, 2024) let the DAO sell EKUBO daily on the open market via its own DCA extension. This gave the community ample time to buy at a ~$10M FDV, with an average price around $1.02.

Thanks to this DCA sale, Ekubo built its initial treasury by selling 3,269,920 tokens in exchange for:

343.675 ETH

1,204,770 USDC

1,549,920 STRK

6. Transparency over team vestings / sales

All supply is live and onchain. No vesting. No unlocks. No VCs. The team’s 33.33% share is traceable here.

And the buyback contract is fully onchain and triggerable by anyone.

TL;DR of the 6 key points on tokenomics

Fair distribution: 66,6% to the community (33,3% airdrop + 33,3% open market sale), 33,3% to the team with a public no-sell commitment.

Zero emissions; 100% of the supply is already circulating. MC = FDV. 0 Inflation risk.

Clear token demand: Revenue funds token buybacks (~200k Ekubo tokens bought so far). EKUBO is also used across DeFi as collateral, for lending, in governance, and as a gas fee token on Starknet.

Active, decentralised governance; 31 proposals, half community-led, 62% $EKUBO staked.

Low launch valuation; the two-month DCA sale priced EKUBO at about $10M FDV, giving retail buyers the same entry point that insiders usually get in private rounds of other projects.

Full onchain transparency; No VC unlocks or hidden emissions. Everything is traceable and verifiable.

Ekubo is breaking the retail extractors tokenomics cycle by launching from day one with a low-valuation, high-float model (100% float right now). The team chose not to take shortcuts with private funding, fully bootstrapping instead. Any large buyer (like Delphi Digital) had to acquire tokens from the open market.

Compared to top-volume AMM competitors, the difference is clear:

Ekubo tokenomics are much better (nfa dyor toussa toussa, I’m bag holder).

IX. Risks

Even with Ekubo’s strong fundamentals, several risks remain.

The first, and arguably the most important, is that the project is still entirely driven by a small team, especially by Moody. At this stage, everything continues to revolve around him. While the DAO is expected to progressively take on more responsibility, it will likely take time before Moody’s role can be reduced to the point where his potential departure (to be clear, there's no public indication he plans to step away) would have limited impact.

The second risk relates to Moody and Ekubo Inc.’s decision not to actively handle marketing and business development.

Below are some areas that Ekubo, Inc. will not focus on, and Ekubo protocol would benefit from ecosystem participation:

Liquidity provider tooling

Advanced analytics, e.g. revert.finance

Automated liquidity management (e.g. Arrakis)

Market analytics, e.g. Dune dashboards

Aggregators and advanced routing integrations (e.g. AVNU)

Marketing and community management

Hackathons, event sponsorship and representation

User guides and documentation

Taking over the protocol X account

Centralized exchange listing, and other token integrations

source

While the rationale behind this choice is understandable, it does have short-term consequences. Ekubo’s low visibility on Twitter and within the broader DEX narrative reflects this. Discussions are already underway around who could take on this role, with proposals emerging.

Another risk is that Ekubo’s revenue is entirely dependent on its ability to attract liquidity. And while it may be the most efficient AMM out there, efficiency alone isn’t enough to bring in fresh TVL. So far, the protocol has been growing TVL on Ethereum at a slow pace.

Lastly, as with any DeFi protocol, smart contract risk is always present. That said, Ekubo mitigates this through a robust audit process, every major product or contract goes through formal reviews, and thanks to Moody’s unmatched credibility. You can find all of Ekubo’s audits here. As for Moody: he wrote half of Uniswap v3 and led the design of v4. A true chad, trusted by OGs.

Conclusion

Trading remains crypto’s biggest use case, and Ekubo is building the best liquidity layer for it.

Whether you're a trader chasing best execution, an LP optimizing for yield, a gem hunter exploring early-stage protocols, or a DeFi builder shipping the next primitive, Ekubo delivers everything you need, and does it better than anyone else.

If you're a trader, you want best-in-class execution: low slippage, deep liquidity, and gas efficiency. Ekubo delivers all of that by design, thanks to ultra-concentrated liquidity, its singleton architecture and Till pattern. You can swap directly on Ekubo (using market orders, limit orders, or even DCA) or go through an aggregator on Ethereum or Starknet.

If you're an LP, you want to do more with less. Ekubo offers top-tier capital efficiency, with tick sizes as small as 1/100th of a basis point, 100× smaller than competitors. You can concentrate liquidity with surgical precision, automate strategies, and stay in range longer.

If you're a gem hunter, you're early to one of the most promising protocols in DeFi; token 100% float, no VC overhead, no offchain value extraction. Everything flows back to the protocol and its token holders, and its multi-chain expansion has only just begun (nfa dyor).

If you're a DeFi builder, Ekubo gives you modular, permissionless infrastructure. With extensions, you can deploy any DeFi primitive directly on top of the most efficient liquidity layer in the space.

Whoever you are, Ekubo gives you the edge.

Ekubo was already the AMM endgame when I wrote this back in September 2023. Since then, it’s just proving it.

Don’t fade what’s next.

To follow its evolution more closely, keep an eye on the people building and tracking it day after day:

Ekubo looked good before. Now it looks inevitable.

None of this content is financial advice. Stay SAFU and always do your own research.

Appreciated this piece? Subscribe to this research space and follow me on Twitter to get more, it is totally free!