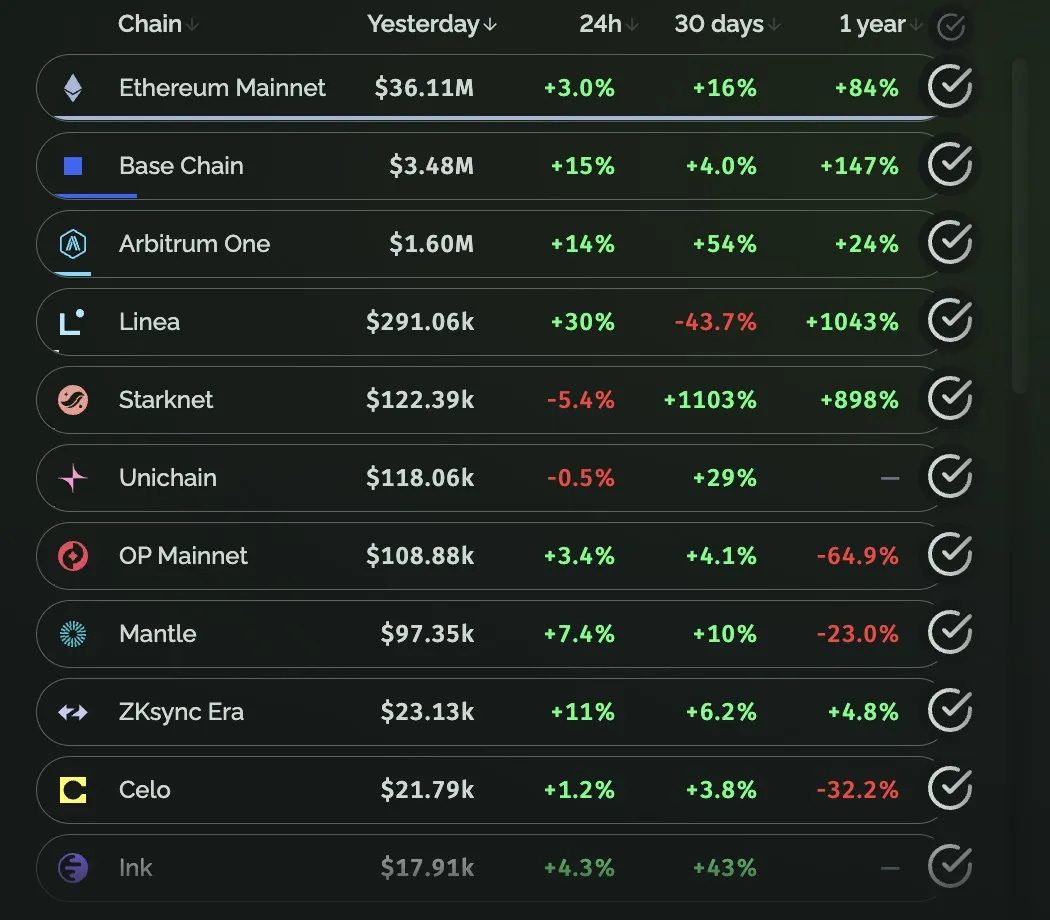

Starknet Q3 recap

What Starknet built, what’s coming next, and why nothing else compares.

Introduction

Welcome to the Starknet Q3 2025 recap, a quarter that reshaped the network’s trajectory.

And with it, a new era is unfolding on Starknet: Bitcoin DeFi, decentralization, ultra performance, and an expanding wave of real use cases converging into one ecosystem.

If you’re looking for the most exciting frontier in crypto today, you’re in the right place. Let’s dive into how Starknet is steadily becoming the endgame layer, built to last beyond every cycle and narrative.

Bitcoin on Starknet is becoming Real

After a full year of preparation, Starknet has finally made the leap and launched real products that position it as the best place for Bitcoiners to do more than just HODL.

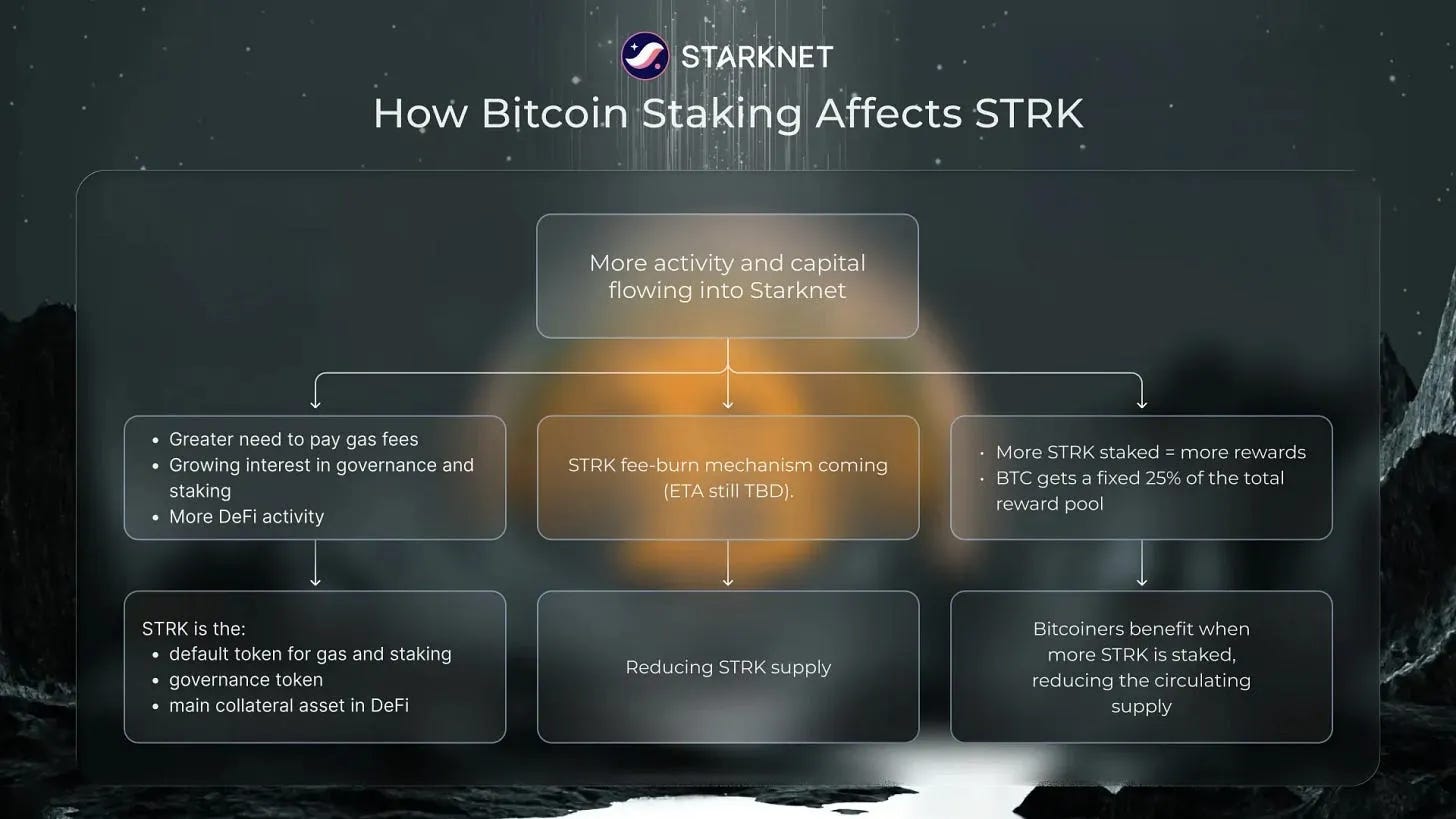

The first major milestone is the launch of Bitcoin staking on Mainnet, making Bitcoin staking part of Starknet’s consensus.

Bitcoiners can now stake their BTC to secure Starknet and earn STRK rewards in return. This makes Starknet the first rollup to operate a dual-token consensus model: STRK represents 75% and BTC 25% of the network’s security.

This brings several benefits:

Purposeful Bitcoin Yield: Starknet is the only place where Bitcoiners can earn yield that directly strengthens the security of a Layer 2 poised to become Bitcoin’s execution layer.

Cost-Efficient Security: Bitcoin’s status as the ultimate store of value means Bitcoiners are willing to accept lower yield for high security. This lets Starknet strengthen its consensus at a lower cost compared to STRK.

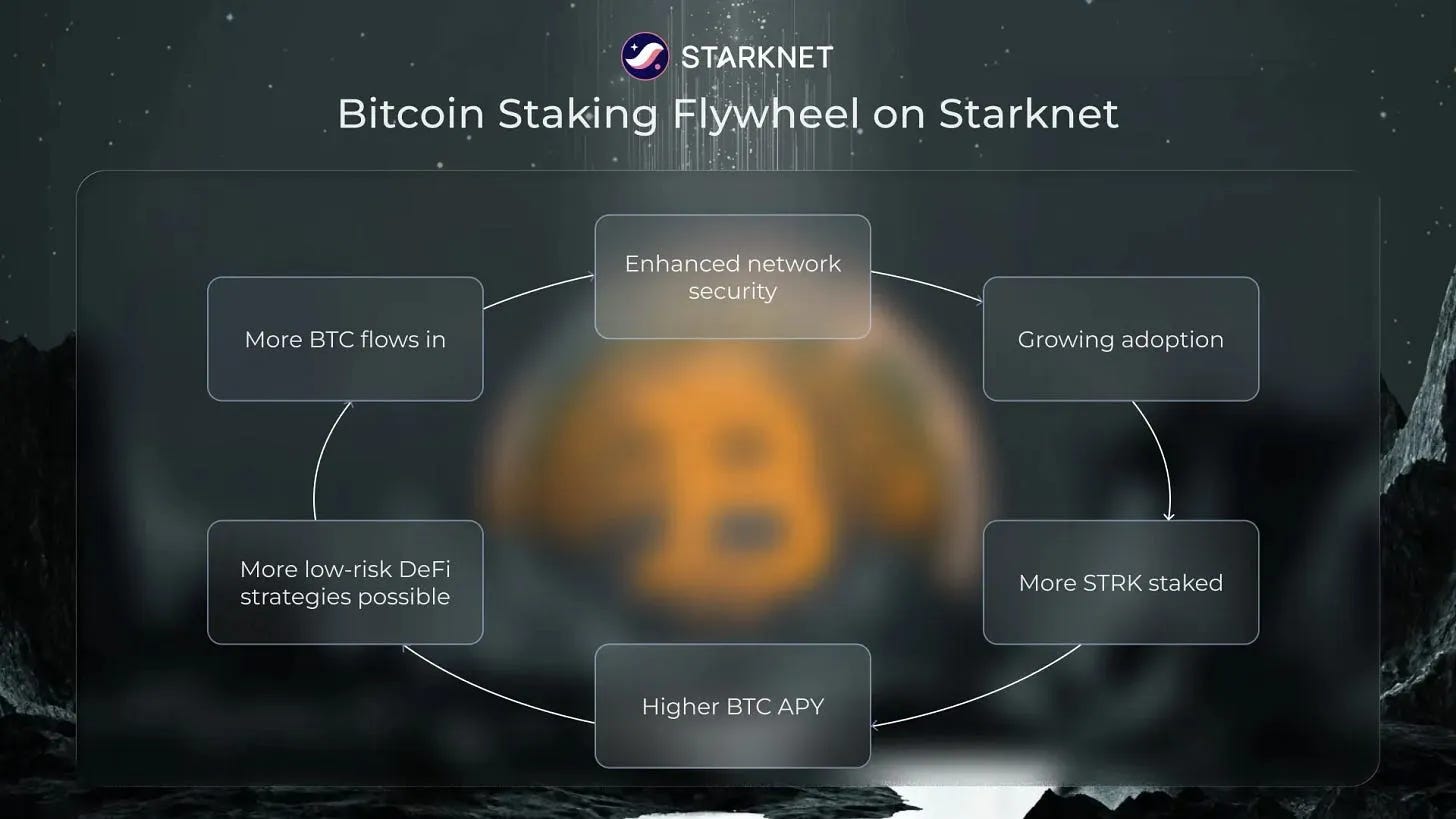

STRK-BTC Alignment: STRK and BTC are now economically intertwined. The more STRK that’s staked, the more STRK is allocated for staking rewards. Since Bitcoiners receive a fixed 25% of total STRK emissions, as more STRK is staked, Bitcoiners earn more rewards. This means Bitcoiners have a real interest in seeing STRK grow in value and being staked.

Putting it all together, these elements create a powerful flywheel that reinforces both STRK’s utility and Bitcoin’s integration into the Starknet ecosystem.

And notably, all of this is happening while keeping STRK inflation very low. For instance, even with both BTC and STRK staking combined, inflation remains around 1% at 800 million STRK staked, and only about 1.4% if double that amount is staked (1.6 billion STRK).

Learn more about BTC staking on Starknet.

But the momentum doesn’t stop with Bitcoin staking.

To kick this flywheel into high gear, Starknet has introduced BTC Season, a 100 million STRK incentive program designed to make Starknet the ultimate place for Bitcoiners to earn yield and borrow against their BTC at minimal cost. This incentive budget will be distributed over a period of six months, primarily across three key areas:

BTC Liquidity on DEX (Ekubo)

BTC Liquidity on lending platforms (Vesu, Uncap, Opus)

Subsidizing interest rates for BTC-collateralized borrowing

You can learn more about this new incentive program here.

All of this is amplified by a series of strategic partnerships that make Starknet’s Bitcoin integration even more robust:

Re7: Offering a market-neutral, BTC-denominated strategy for institutions (~20% APR).

LayerZero and Stargate: Finalizing Starknet integrations in November.

Native USDC and CCTP v2: Arriving by the end of November/Beginning of December.

Native WBTC Support: Native and bridged WBTC now mintable directly on Starknet, eliminating the need to go through Ethereum.

LBTC, tBTC, SolvBTC: Leading Bitcoin wrapper assets now integrated into the ecosystem.

Alpen and StarkWare: Building a trust-minimized bridge between Bitcoin and Starknet, making DeFi without wrappers possible.

Xverse Wallet: The leading Bitcoin wallet is now fully compatible with the Starknet ecosystem.

As a result, Starknet instantly becomes far more attractive not only for Bitcoiners but also for builders eager to leverage this growing ecosystem. On top of these integrations, a wave of new products have launched on Starknet:

Endur: BTC liquid staking is now live.

Vesu: integrated BTC liquid staking tokens into its lending and borrowing markets, and launched its V2 to power the BTCFi era.

Re7 x Midas: Re7’s Bitcoin Yield Fund (~20% APR) is tokenized by Midas, making it accessible to everyone and usable as collateral across Starknet DeFi.

Spline Finance: launching BTC-powered stablepools built on top of Ekubo.

0DFinance: introducing one-click vaults that generate yield on Bitcoin.

Ready: integrating BTC staking and Vesu vaults directly into its wallet interface.

Voyager: releasing a new dashboard to track all BTC and STRK staking metrics.

AVNU: integrating all wrapped BTC into its app and allowing users to pay gas fees with these tokens across the entire network.

Uncap: launching the first stablecoin fully backed by Bitcoin on Starknet.

Noon Capital: bringing its USN (base stablecoin) and sUSN (staked version of USN that generates yield through Noon Capital’s strategies) on Starknet.

Typhoon: expanding its mixer to support all BTC wrappers, now with lower fees.

The results of all these launches are already visible:

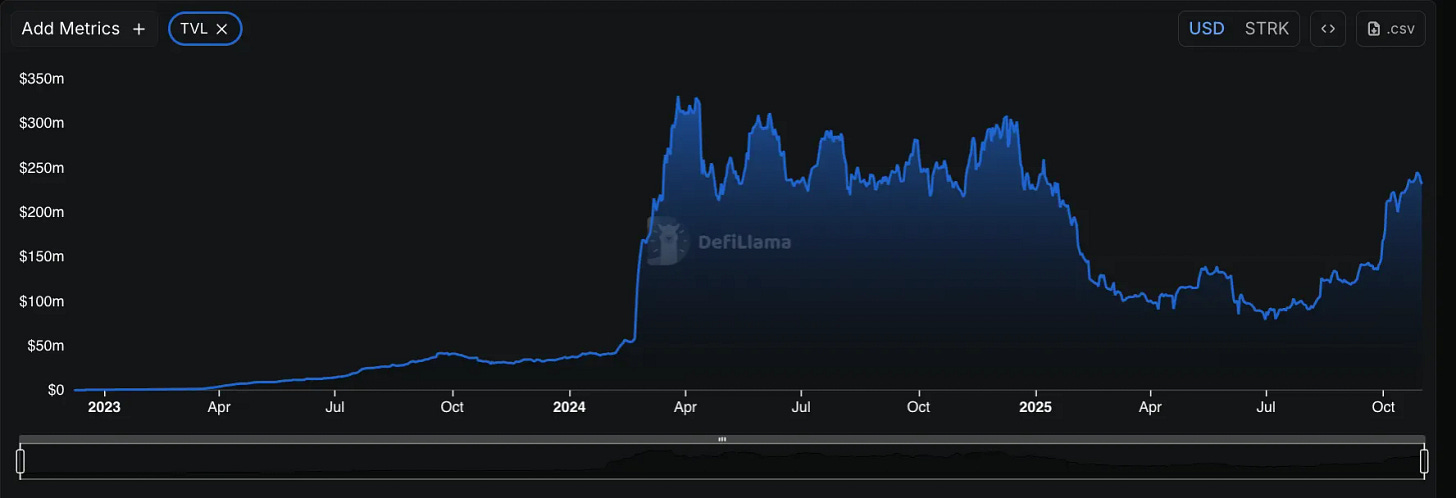

Starknet’s TVL has tripled from its bottom and doubled since the BTCFi era began.

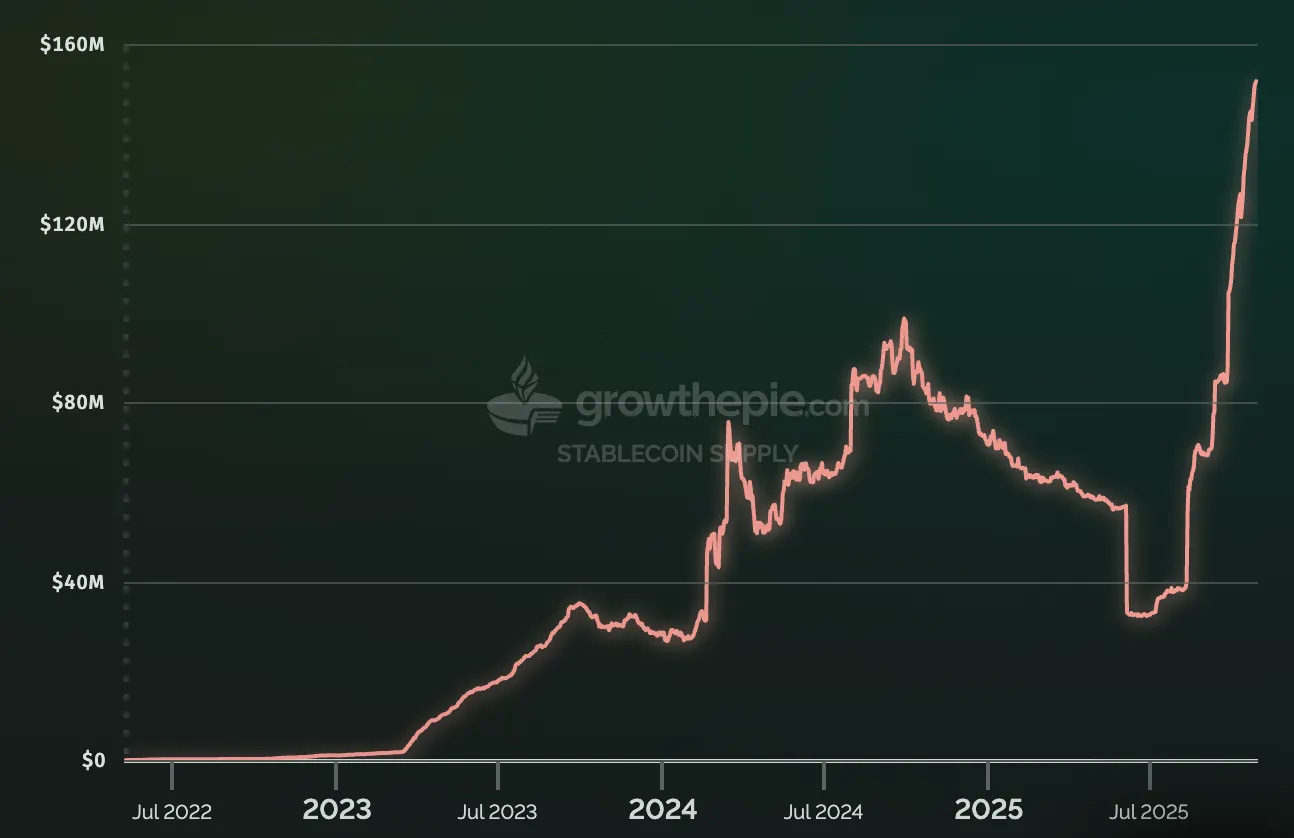

Stablecoins on Starknet are hitting new all-time highs above $150M.

The network is now one of the top four rollups by app revenue.

Over 650 BTC are already staked (~$72M).

More than 1,000 BTC have been bridged in just three weeks.

Still day 1 tho.

Grinta Is Live: Faster, Decentralized Starknet

Starknet v0.14.0, also known as Grinta, launched on Mainnet on September 1st. This upgrade introduces major improvements to the network, the most notable being a decentralized sequencer architecture.

Starknet is now the first rollup powered by multiple sequencers; three sequencers are operating on the network using Tendermint consensus with a 1/2 threshold. This is a huge step forward because rollups have long been criticized for relying on centralized sequencing. Having multiple sequencers means no single entity can halt the Starknet chain or extract MEV, making the network far more decentralized and censorship-resistant.

That being said, currently, the three sequencers are run by StarkWare, but soon anyone will be able to participate. The next step after that is to decentralize validation.

Alongside this big shift, Grinta also introduces several other enhancements:

Pre-confirmations: A new intermediate transaction status with ~0.5s latency, making most transactions feel near-instant (from ~2 seconds down to just 500 milliseconds).

Mempool upgrade: Transactions are now prioritized by tip rather than strict FIFO ordering. Pay more, get in first.

Reduced block times: Block times have been cut from 30s to 4s, with plans to reduce them further this year.

Fee market for

l2_gas: Inspired by Ethereum’s EIP-1559, introducing base fees and tips. Base fees won’t be burned yet, but that’s coming in a future update.v3 transactions only: From now on, only v3 transactions are supported, and they require STRK for gas fees. To pay in other tokens, you’ll need a paymaster like AVNU.

Staking on Starknet: going brrrr

In addition to the introduction of Bitcoin staking, Starknet has also made significant improvements to its overall staking system. One major enhancement is the reduction of the unstaking period from 21 days to just 7 days. This means that when users decide to unstake their assets, they only have to wait a week before those assets become liquid again.

With the arrival of BTC staking and this streamlined unstaking process, the new parameters of Starknet’s staking are as follow.

During Q3, both StarkWare and the Starknet Foundation began actively participating in staking. They started delegating STRK to existing validators, so if you run a validator or want to become one, you can apply for additional STRK from both:

This dual opportunity allows validators to receive extra STRK from both entities at once (so apply to both, not just one!).

Moreover, StarkWare itself has launched its own validator with 30 million STRK staked. And also Anchorage Digital, a leading institutional custodian. This is a significant development, as it allows institutions and large players to securely stake their STRK through a trusted provider.

In total, more than 800 million STRK are now staked on the network, representing over 19% of the circulating supply, a 120% increase since Q2. Alongside this, 659 BTC are also staked, bringing the total value staked on Starknet to over $150 million.

Starknet: The Best Rollup Stack

This is your quarterly reminder that when it comes to rollup technology, Starknet stands out as the most advanced stack in the market, and the numbers continue to prove it month after month.

Starknet is unique in its security model: it’s the only rollup in production that uses a proving system (ZK-STARKs) without any trusted setup or assumptions. This ensures a higher level of trustlessness compared to other rollups. In addition, Starknet is powered by a proving system that is quantum-resistant.

In terms of performance, Starknet has recently achieved record-breaking throughput. With peaks of 2,630 UOPS and a sustained rate of 273 UOPS over an entire day, Starknet is capable of handling over 2,600 transactions per second right now. This puts it ahead of other rollups and highlights its capacity to support large-scale applications.

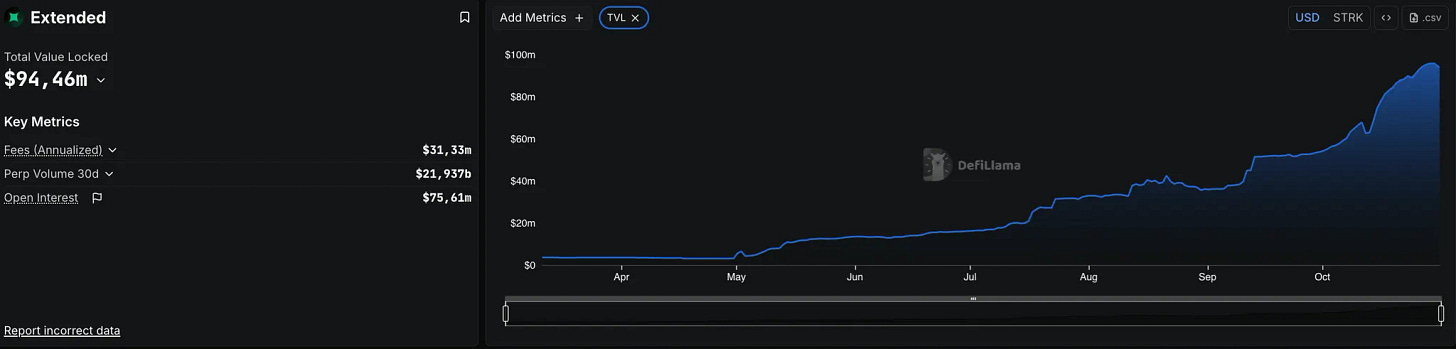

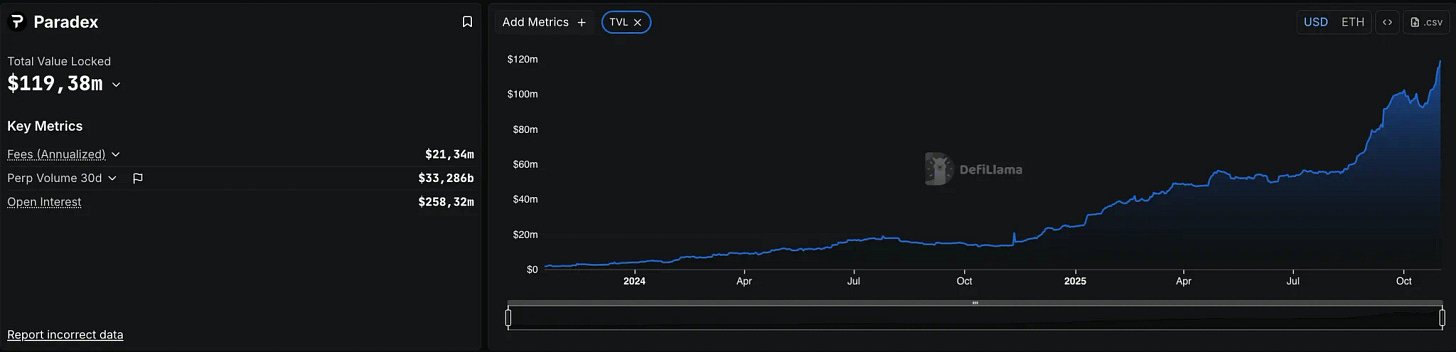

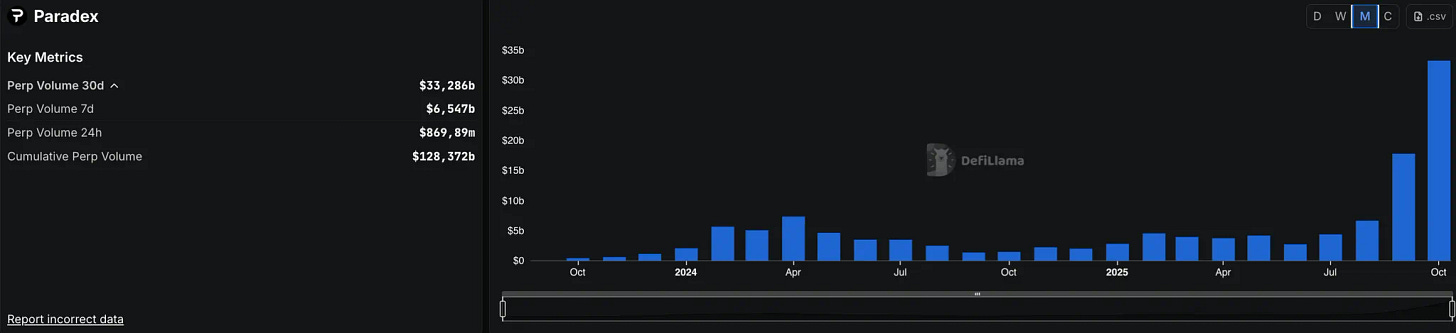

Not only does Starknet stack lead in raw performance, but it also powers three of the top ten perpetual DEXs by volume:

Paradex, Starknet appchain

Extended, Public Starknet

and edgeX, StarkEx

Together, these platforms generated over $170 billion in volume last month alone.

As the ecosystem continues to evolve, Starknet is working on integrating privacy features, ensuring that it remains the ultimate layer by combining decentralization, security, scalability, and privacy all in one.

In short, Starknet is setting the pace as the most advanced rollup stack out there.

Starknet: More Accessible Than Ever

Starknet continues to break barriers and become even more accessible thanks to a wave of new integrations.

In addition to the integrations I’ve already mentioned (LayerZero, Stargate, Native USDC, and Xverse), there are two other key integrations now live that are expanding Starknet’s connectivity to the broader blockchain world.

First, Hyperlane has officially integrated Starknet into its interoperability stack. This integration allows developers to create bridges and cross-chain applications that connect Starknet with over 150 different chains. As a result, three products are already leveraging this capability:

The Solana ↔ Starknet bridge on StarkGate, which lets users move SOL, DREAMS, TRUMP, JUP, BONK, PUMP, Fartcoin, between Solana and Starknet.

A specialized Solana ↔ Starknet bridge for the DREAMS token.

ForgeYields, which uses this integration to power cross-chain yield strategies.

In addition, Starknet is now integrated into the RocketX solution. This integration enables users to bridge from over 180 chains to Starknet with minimal slippage, even for large swaps. RocketX achieves this by leveraging centralized exchange liquidity (Bybit/HTX) and then delivering the funds directly to users on Starknet.

In short, these integrations are making Starknet not only more connected but also easier to use, helping onboard more users and builders seamlessly.

Starknet: Ushering in Mass Adoption with Seamless UX

The Starknet ecosystem keeps pushing major achievement to make crypto truly accessible for everyone, even normies. Thanks to Starknet’s native account abstraction, builders can offer a user experience that hides the complexities of blockchain while retaining all the security benefits.

For example, the Starknet Paymaster by AVNU is now fully live and open source, allowing developers to completely abstract away gas fees. Users can either have their fees covered by the app or pay in any token they prefer, making the experience seamless. This feature is already being leveraged by apps like Ready Mobile and Cavos to provide a fully gasless UX. Cavos also adds social login on top of that.

Speaking of social login, Cartridge has introduced Gmail login for its Controller (gaming-focused wallet), allowing users to create wallets and access Starknet using just their Gmail account, in addition to EVM wallets and Discord login, making onboarding even more straightforward for gamers.

In short, Starknet is building the perfect environment for mass adoption by making crypto as easy to use as any Web2 application. It’s not just about having the best tech stack; it’s about making that stack invisible to the end user.

A Next-Gen Perp DEX Now Available on Public Starknet

Extended is now fully live on Starknet Mainnet, bringing:

leverage trading up to 100×,

over 50 pairs, including major TradFi assets like Gold, EUR/USD, and Oil,

and vaults yielding over 25% APY in USDC.

Led by a team of former Revolut executives, Extended has quickly become the top app on Starknet by TVL, attracting over $90 million in USDC and hitting new weekly volume records.

A very strong start.

If you’re wondering why a team of former Revolut executives chose to build on Starknet, here’s the answer straight from the CEO himself.

Paradex enters its escape velocity era

As a standalone Starknet appchain built specifically for Perps, Paradex is accelerating at a rapid pace. They’ve rolled out major initiatives to expand their market share, most notably:

An extension of Season 2 of their XP campaign, allowing them to roll out their full product suite, spot markets, pre-market, yield-bearing synthetic dollars, and more, before TGE.

The introduction of 0% trading fees for retail users, both maker and taker, across more than 100 Perp pairs.

The result? Paradex now offers better execution than CEXs, with full self-custody and onchain settlement. Their metrics are going parabolic.

If you’re trading Perps, you should definitely take a look at Paradex.

And if you want to position yourself ahead of the upcoming $DIME TGE (Paradex token), you can:

Trade Perps or Perp Options

Provide liquidity in the Gigavault, which has yielded 36% since launch on USDC

Buy and hold a Shizopunk (NFA, DYOR, just my take, not validated by the team)

In general, if you want to understand why I’m gigabullish on Paradex, and why I believe it’s currently the most innovative Perp DEX out there, take 10 minutes to read this article.

Other Q3 Highlights

A lot of important news was announced during Q3, including:

Two projects have recently launched extensions on top of Ekubo, expanding its ecosystem. Re7, a $1B fund, has launched a Yield Aggregator that passively manages LP positions on Ekubo. Users can now deposit once and let Re7’s algorithm handle the rest. The product has already surpassed $15M in TVL. Spline Finance, another yield aggregator, optimizes BTC-backed stablepools built on top of Ekubo.

The Ready Metal Card is now restocked and available for everyone, without any waitlist. This self-custodial debit card offers 3% cashback (up to 10%), 0% FX/bridge/deposit fees, and global Mastercard support, meaning you can basically use it anywhere. Order yours now!

You can now trade on Starknet with liquidity from Layer Akira: SOL, ZRO, BONK, JUP, ARB, FARTCOIN, SHIB, and TRUMP.

New projects live on Mainnet

DeFi

Extended, a next-gen Perp DEX built by ex-Revolut executives.

Typhoon Mixer: a privacy-focused mixer for Starknet.

ForgeYields: a cross-chain yield aggregator offering up to 15% APR on USDC, 9% on ETH, and 3% on BTC.

Kapan Finance: a lending aggregator optimizing borrowing and lending strategies.

Just Brove It: an app integrating everything Bitcoin-related available on Starknet.

Spline, a stableswap protocol for Bitcoin assets on Starknet.

Re7 Yield aggregator, a yield aggregator built on top of Ekubo

Uncap, a stablecoin fully backed by Bitcoin.

Noon Capital, issuer of yield-bearing stablecoins.

OdFinance, a vault manager.

Caddy Finance: a BTC vault generating yield for Bitcoiners.

Gaming

Block Rooms: the first fully on-chain FPS game.

Bro Jump: a game developed in partnership with the well-known Starknet Brother memecoin.

Panenka FC: a fantasy football game.

Stark Mining: a new mining game.

Payments

Dash: a payments protocol designed to make transactions on Starknet simple.

Pay Mesh: another payments protocol.

Due Network: a payment solution supporting 80+ countries and 30+ currencies.

Other

Schizodio: a new NFT collection that sold out and is now trading well above mint price.

idOS: a reusable KYC protocol.

What’s next?

Every quarter when I write this recap, I’m always surprised by how much this ecosystem ships. And the good news is, it’s not slowing down anytime soon.

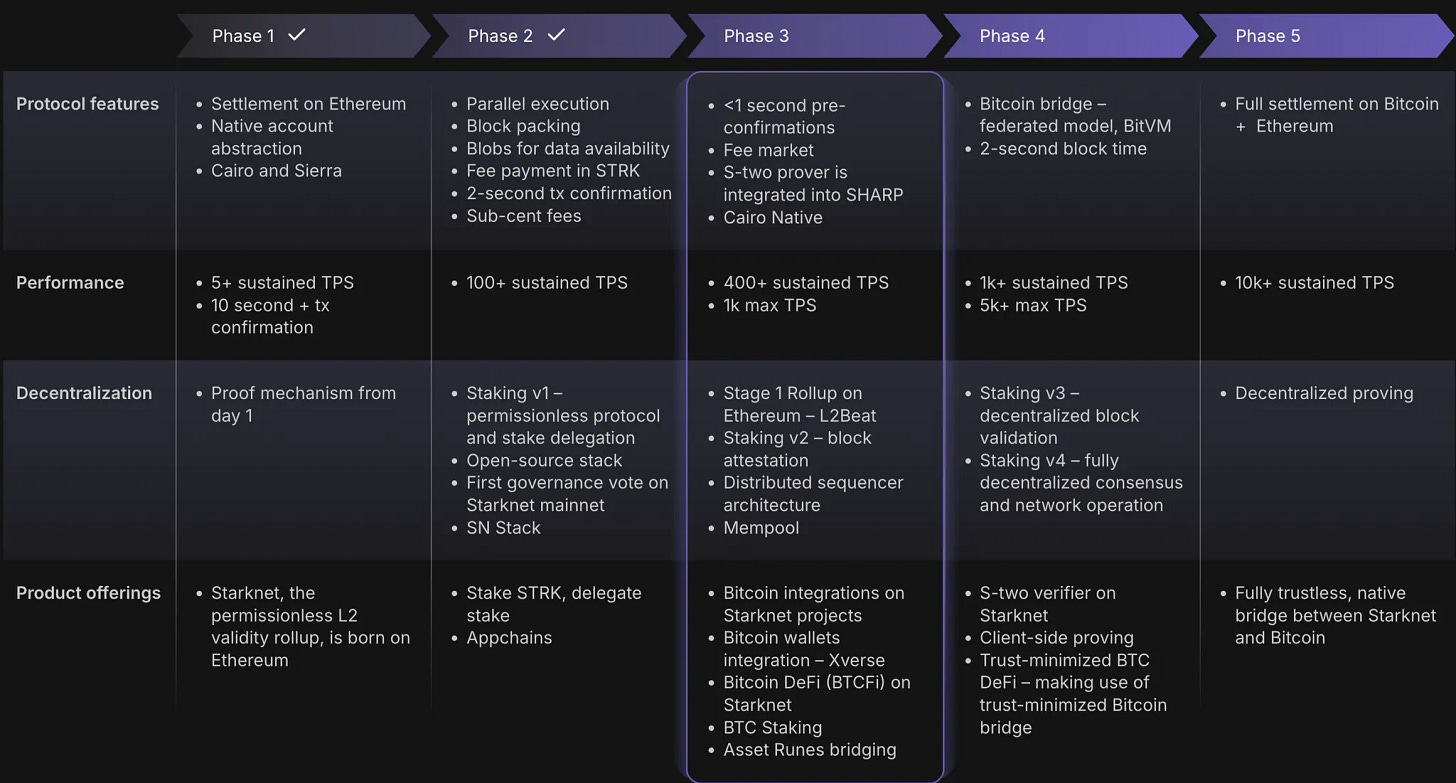

In terms of protocol upgrades, a lot is coming, as you can see below:

Among the most notable upcoming milestones (non-exhaustive list):

LayerZero, Stargate, CCTP v2 & Native USDC integrations (November)

The BTCFi era continues, with new products, use cases, and partners

S-two integration on Starknet (already live actually): massive proving performance leap; unlocks new use cases such as client-side proving

Privacy on Starknet (Q4 2025 / Q1 2026)

Starknet Earn with EVM wallet integration (Q4 2025): a unified portal aggregating all Bitcoin yield opportunities on Starknet, featuring one-click UX and full EVM wallet support

Staking v3 (Q4 2025 / Q1 2026): validators will attest and vote on sequenced blocks, another key step toward full decentralization

STRK burn mechanism (via fees): coming, timeline not yet confirmed

New STRK mechanisms improving token utility (still in whitepaper stage, no ETA yet)

Decentralized validation (2026): completing the decentralization journey for sequencer and prover layers

Staking v4 (2026): the final phase of staking, enabling full decentralization of both the sequencer and prover stack

BitVM-powered bridge by Alpen (Q2 / Q3 2026): enabling Bitcoin DeFi without wrapped assets

Conclusion

In summary, this quarter has been a monumental leap forward for Starknet. From integrating Bitcoin staking and rolling out the Grinta upgrade to seeing a wave of new projects and partnerships go live, Starknet is rapidly evolving into a comprehensive, multi-faceted ecosystem. It’s becoming the go-to layer for both Bitcoiners and builders, offering unmatched scalability, decentralization, and a rapidly expanding set of use cases. With all these advancements, and soon privacy on top, Starknet is gradually becoming the real endgame of blockchain.

If you want to make sure you never miss an update on the evolution of our ecosystem, be sure to follow the entire Starknet ecosystem crew here.

None of the content of this newsletter is financial advice. Always do your own research.

This article was originally published on the Starknet website and on X, authored by me.

That was my favourite lesson this year: PLATFORM PARTNERS PRODUCT 2 ensure the client is key in web3. Orginized, structured and most of all dominance led the article!

I loved this article thank you team for that delight.