Starknet transforming the narrative forever: Bitcoin and Ethereum unified on a single layer

Introduction

Imagine a world where the two largest assets and ecosystems in our web3 universe unite and collaborate on the same layer. The potential would simply be insane. This world, once an impossible vision, is now within reach, all thanks to a simple opcode, OP_CAT, and StarkWare's new approach.

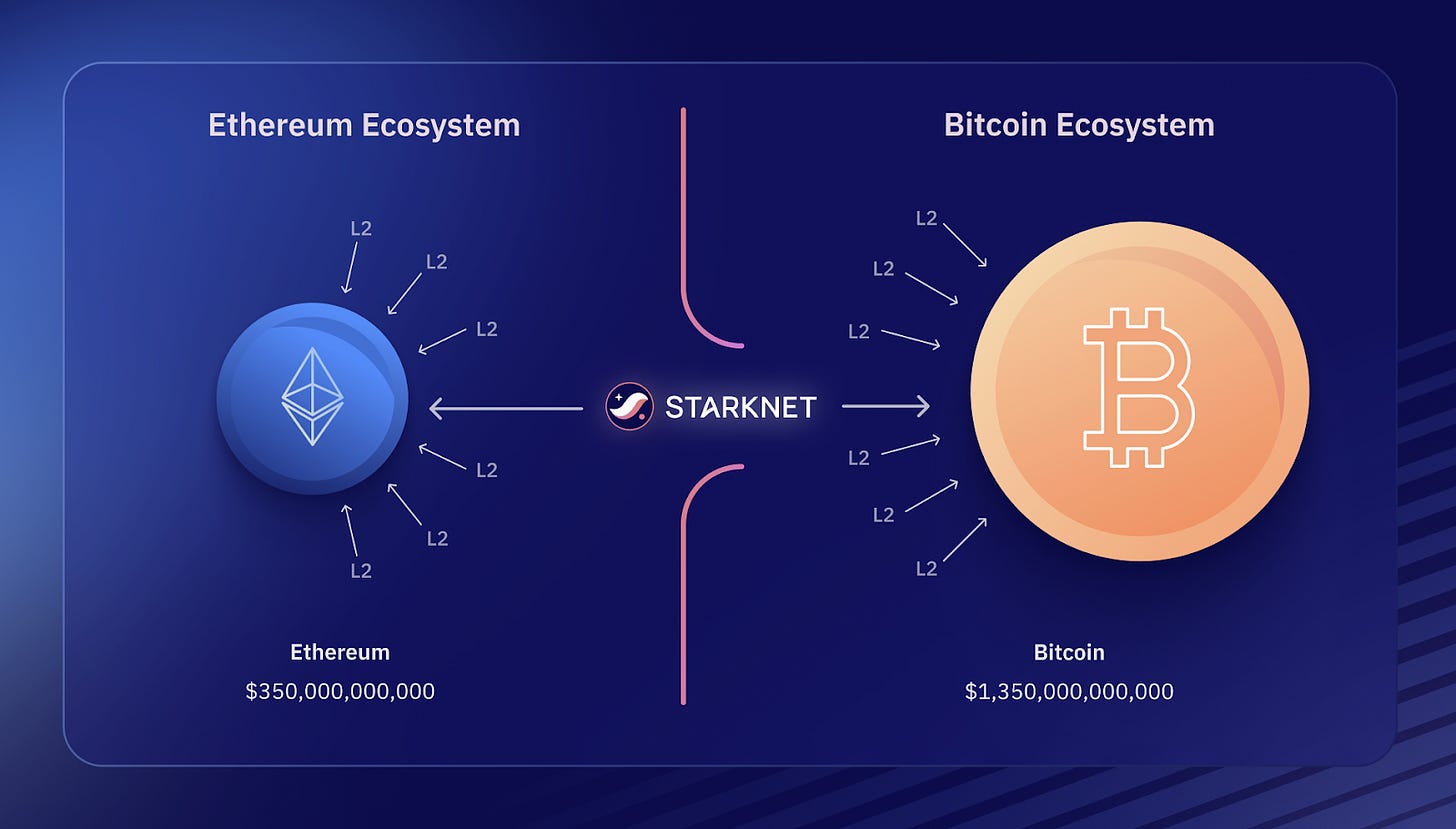

Recently, StarkWare unveiled its ambitious plans to scale Bitcoin with Starknet, positioning Starknet as the first L2 capable of scaling two blockchains simultaneously — Bitcoin and Ethereum. If this vision comes to life, it could redefine how we perceive cross-chain collaborations and revolutionize the future of the entire crypto ecosystem.

With this bold vision, Starknet has the potential to reshape the narrative forever: Bitcoin with Ethereum rather than Bitcoin vs Ethereum.

Outline of this article

Part I: Bitcoin and its scaling challenges

Introduction to Bitcoin

Bitcoin: A non-scalable Blockchain

The rise of onchain activities on Bitcoin

The Bitcoin L2 landscape and OP_CAT as a potential savior

Part II: Why Starknet can be the best option to scale Bitcoin

Wait wtf, Starknet on Bitcoin? Isn’t It an Ethereum L2?

StarkWare: a scaling giant

StarkWare’s current work on Bitcoin

Wen wen wen

Part III: Benefits for both ecosystems

For the Bitcoin community

For the Starknet community

Part I: Bitcoin and its scaling challenges

1. Introduction to Bitcoin

What is Bitcoin, in brief? Bitcoin is both the first and the most secure blockchain, as well as the most egalitarian currency ever created.

The first point to note is that while Bitcoin is often referred to as a cryptocurrency, it’s important to understand that it is, first and foremost, a blockchain: a decentralized and immutable digital ledger that securely and transparently records all transactions. Each block in the chain contains a set of transactions, and these blocks are linked together using cryptographic techniques. The entire system is monitored and secured by Bitcoin miners.

Thanks to its history, decentralization, and PoW consensus, Bitcoin is today the most secure blockchain in the world (a particularly interesting point for L2s, but more on that later).

Source: https://bitinfocharts.com/comparison/bitcoin-hashrate.html#alltime

Created in 2009 by Lord(s) Satoshi Nakamoto, Bitcoin initiated the blockchain and cryptocurrency revolution, serving as a model for many others. Without Bitcoin, there would be no Ethereum, no smart contracts, no DeFi, no NFTs, no shitcoins, and no memecoins. In your maximalism, never forget that Bitcoin started it all. It’s also the flagship of the crypto ecosystem: Bitcoin is the cryptocurrency that most people heard about first, and it represents the gateway to our world for “normies,” traditional financial institutions, and Web2 companies. The most recent example is the approval of Bitcoin ETFs in the U.S. and the launch of Bitcoin ETFs by giants like BlackRock.

Thanks to all these elements, Bitcoin remains the largest cryptocurrency by market capitalization (MC), with a valuation three times that of Ethereum and an overall market dominance of over 50%. Bitcoin is by far the leader and the OG of the crypto market. And this is great news because it’s simply the most egalitarian and resilient currency ever created. Bitcoin allows anyone with an internet connection to participate in a global financial system, without distinction of nationality, religion, or socio-economic status. In my view, Bitcoin is a tangible extension of the Universal Declaration of Human Rights:

“All human beings are born free and equal in dignity and rights {…} Everyone is entitled to all the rights and freedoms set forth in this declaration, without distinction of any kind such as race, color, sex, language, religion, political or other opinions, national or social origin, property, birth, or other status. Furthermore, no distinction shall be made on the basis of the country to which a person belongs.”

Access to a quality currency and financial services is one of the most important rights in our lives, as money directly affects every aspect of our daily existence: standard of living, well-being, access to education, health, autonomy, freedom, and more. In today’s world, governments control the issuance of fiat currency, its management, and who can use it. This leads to many abuses, such as:

Inflation (the continuous impoverishment of the population) and hyperinflation (the loss of years, or even a lifetime, of savings),

Corruption,

Constant surveillance,

Exclusion of certain people from the financial and banking system.

And the list goes on… Simply put, through money, governments indirectly control us.

Bitcoin offers a concrete solution to this problem by providing a currency that governments do not control, neither in its issuance nor in its use. Bitcoin is therefore an alternative to traditional currencies, offering a decentralized currency with a predetermined and immutable inflation schedule, open to everyone, and resistant to censorship.

Bitcoin is, in a sense, a public good that everyone should be able to use.

Are you wondering why I say "everyone should be able to use it" when Bitcoin is already an open blockchain and currency for all? Well, that’s the catch 😏

2. Bitcoin: A non-scalable Blockchain

If you're following me and Starknet, you've likely already heard about the blockchain trilemma, which particularly affects Ethereum. Well, Bitcoin is no exception! By optimizing for security and decentralization, Bitcoin has neglected scalability. Bitcoin’s transaction throughput is about 7 transactions per second (TPS), which is even lower than Ethereum’s 15 TPS. This means, theoretically, Bitcoin can only process about 220,752,000 transactions per year. So, only 2.76% of the world’s population could make a single transaction per year.

That's very little—far too little, especially considering that the countries that most need Bitcoin (those most oppressed and impoverished) are often densely populated. If we truly aim for mass adoption of Bitcoin, there’s a clear problem with the current state of things: the more people use the Bitcoin network, the more exclusive it becomes, as transaction fees rise when Bitcoin's mempool fills up. And this demand continues to increase over time, as shown by the three graphs below:

Source: https://dune.com/hildobby/bitcoin

Source: https://dune.com/hildobby/bitcoin

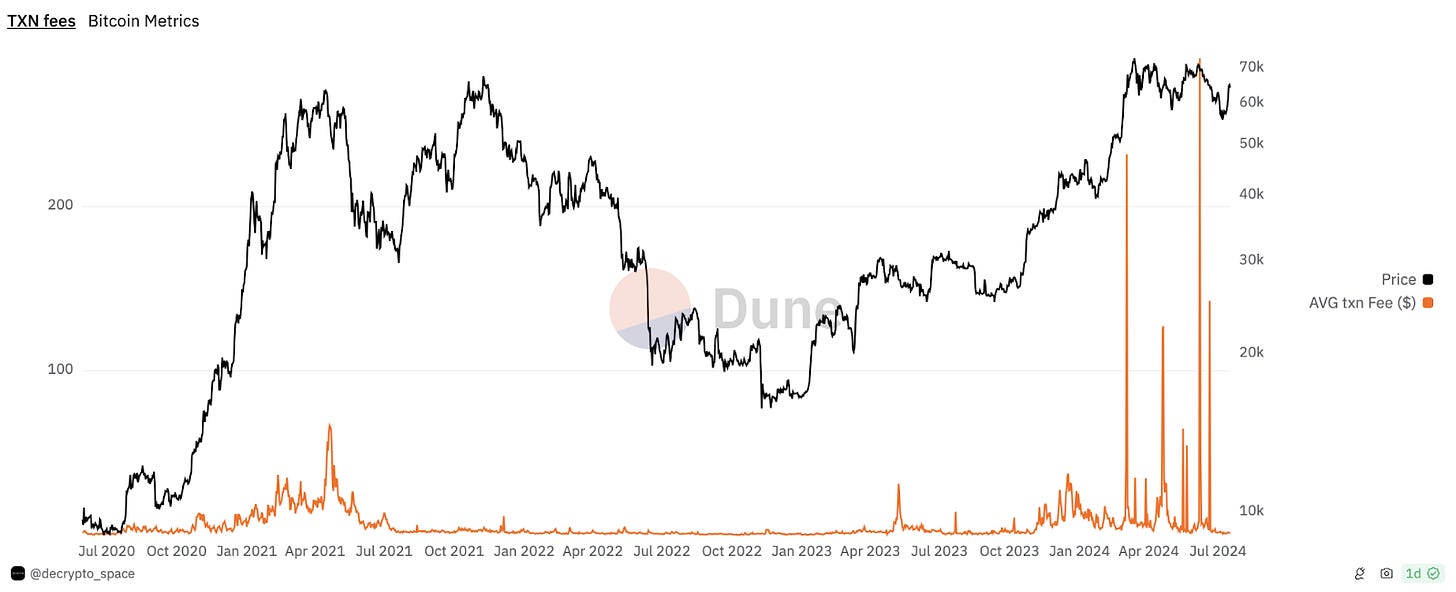

Source: https://dune.com/decrypto_space/bitcoin-on-chain-metrics

Looking at the last graph, we see a clear trend: extreme fee spikes are becoming more frequent and pronounced, all while there’s no DeFi activity on Bitcoin.

As a result, Bitcoin's success over time creates a vicious cycle for those who truly want to use the network; the more popular Bitcoin becomes, the higher its price, leading to more activity on the network, which then drives fees up further. In theory, these fees will only increase over time, as we’ve seen with Ethereum before the rise of L2s and EIP-4844. Additionally, it’s important to note that transactions on Bitcoin are slow af, as they require confirmation across six blocks.

In summary, Bitcoin has very limited transaction capacity, leading to high fees during periods of increased activity, along with very slow transaction times. This is not ideal for use cases such as small payments. And this poses a problem, considering that Bitcoin's whitepaper envisions it as a payment system for all kind of transactions and accessible to all—rich or poor. In its current state, the countries that would benefit most from Bitcoin as a payment tool are often the poorest, where about 1.5 billion people lack access to financial services. Can we realistically expect these people to afford $1 to $2 in fees per transaction? Clearly not.

“Today, there are 1.5 billion people in the world who don't even have a bank account. Bitcoin payments would not just be an alternative for these people but actually their first access to financial infrastructure."

Eli Ben-Sasson

Yet, these are the fees we see today. The average Bitcoin fees are higher than they were a few years ago, and fee spikes are becoming increasingly extreme.

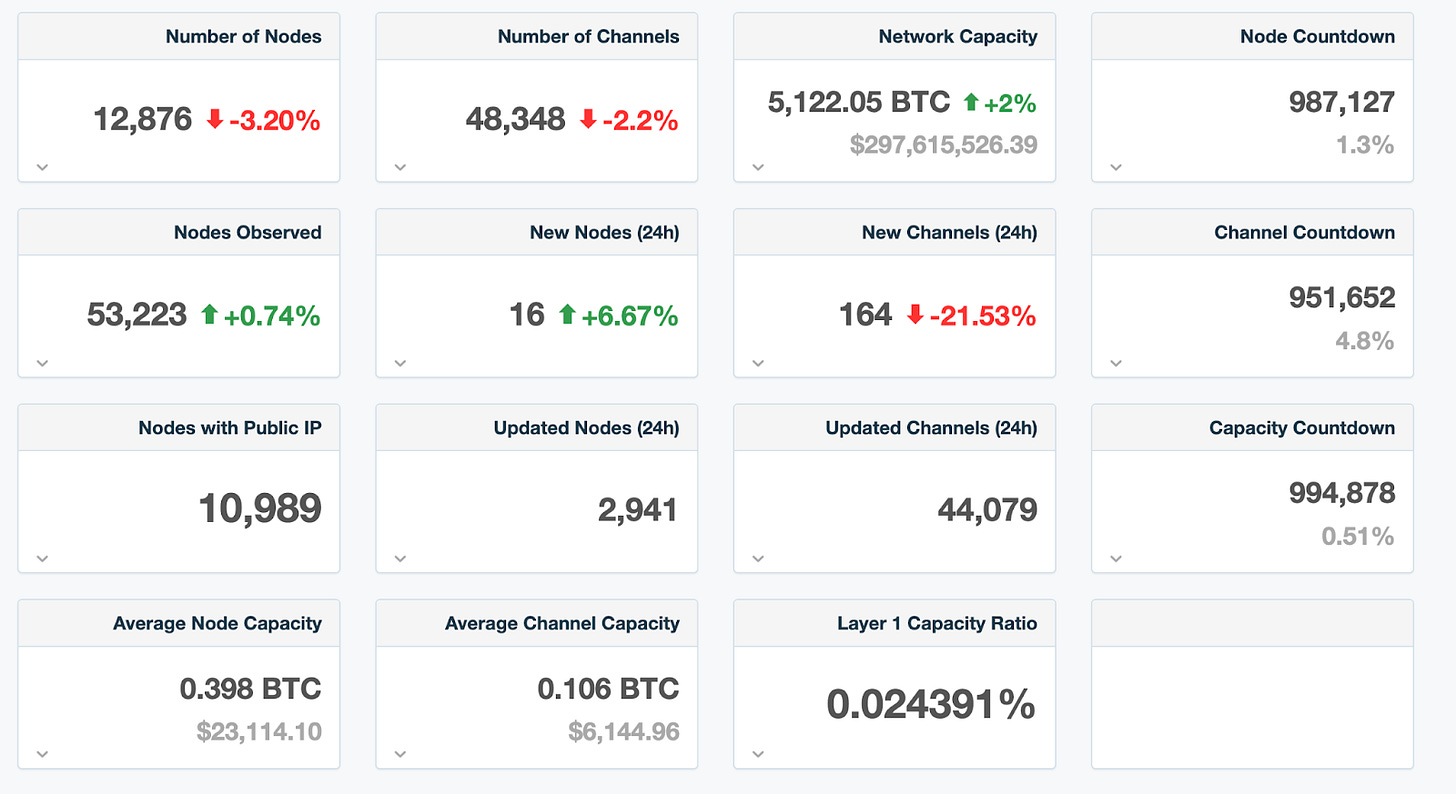

As a result, in its current state, Bitcoin is primarily used as protection against fiat currency inflation and as a speculative asset. To be fair, it can also be used for payments and low-cost & fast transfers, thanks to the only (real) L2 solution currently in production on Bitcoin: the Lightning Network. Simply put, Lightning Network enables quick and cheap transactions off the L1 while benefiting from Bitcoin’s security, as the Bitcoin network validates and settles the opening and closing transactions.

The concept is fairly simple: Lightning Network is a system of bilateral payment channels between two parties. The two parties open a channel between themselves, deposit a set amount of BTC, and can then perform as many transactions as they want (but limited by the channel liquidity)—quickly and cheaply. This allows them to carry out an unlimited number of transactions with only two being recorded on the Bitcoin blockchain:

The channel opening transaction, specifying both parties and the amount of BTC each deposits, forming the total balance of the channel.

The channel closing transaction, which is triggered when both parties decide to close the channel, finalizing the balances reflecting all the exchanges that occurred.

However, the LN has significant limitations, particularly as it is suited only for simple transfer use cases. It also has several other drawbacks, which I encourage you to read about in this article if you're interested. All these drawbacks explain why the Lightning Network is underused by the Bitcoin community.

Source: https://1ml.com/statistics

I sincerely believe that Bitcoin should be used for much more: enabling the majority of people to be completely free and do whatever they want with their money. Beyond its function as a hedge against inflation and a speculative instrument, Bitcoin (in its native form) should be usable in DeFi, for recurring payments (but more efficiently than with Lightning Network), and even for degen activities if some people desire!

Speaking of degen, a new trend has emerged since 2023, enabling new activities on the Bitcoin network, but it has also amplified the fee and speed issues we’ve described.

3. The rise of onchain activities on Bitcoin

Yes, even degens have found something to do on Bitcoin 🙈

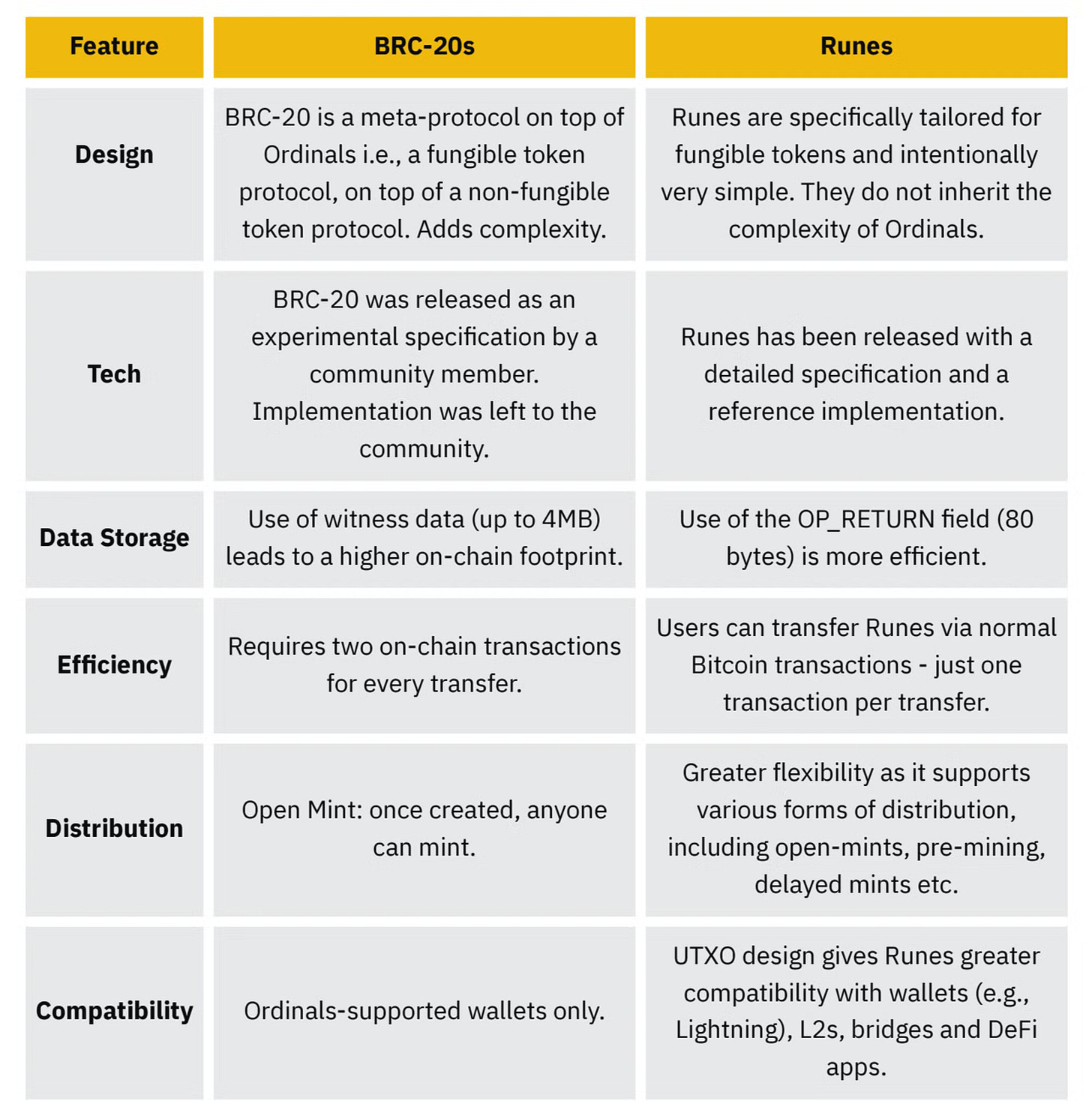

No offense, ofc—I’m a degen myself and have enjoyed seeing these activities emerge on Bitcoin. This was made possible through the creation of Ordinals/Inscriptions, BRC-20, and Runes. To simplify, Ordinals/Inscriptions are Bitcoin’s version of NFTs, while BRC-20 and Runes are the Bitcoin equivalents of Ethereum’s ERC-20 tokens (fungible tokens). BRC-20 is the older standard, while Runes are the new, improved version.

Ordinals came about thanks to an idea developed by Casey Rodarmor in December 2022, introducing the concept of numbering and identifying each satoshi (the smallest unit of Bitcoin) individually. This innovation allows metadata like images, text, and other data types to be inscribed directly onto satoshis. As a result, you can now create and store NFTs natively on Bitcoin. As such, Ordinals are real NFTs, fully secured and decentralized on the Bitcoin blockchain—not hosted on centralized services like most NFT collections on other blockchains. This innovation sparked a massive hype around Ordinals in 2023, leading to an explosion of activity and fees on the Bitcoin network.

A few months after Ordinals were invented, another innovation excited the Bitcoin degen community: the arrival of BRC-20, the Bitcoin equivalent of Ethereum’s ERC-20 tokens. This was a logical next step after NFTs, and two BRC-20 tokens are currently hovering around the top 100 MC: $SATS and $ORDI (NFA ofc).

However, because BRC-20 is built on the Ordinals protocol, it suffers from some inefficiencies. This is where Runes come into play. Runes are a simplified and improved version of BRC-20. I won’t go into the details of the improvements here, but if you want to learn more, here’s an excellent comparison by Binance Research:

Source: https://www.binance.com/en/research/analysis/the-future-of-bitcoin-2-tokens

Now you have an overview of the three most well-known terminologies among Bitcoin degens:

Ordinals/Inscriptions: Bitcoin's equivalent of Ethereum’s NFTs.

BRC-20: Bitcoin’s equivalent of ERC-20 tokens.

Runes: The improved version of BRC-20.

These three new concepts on Bitcoin show the growing appetite for more onchain activity on Bitcoin:

Ordinals caused Bitcoin fees to rise by up to 280% year-to-date in December 2023.

Runes transactions comprise 68% of Bitcoin's total transactions since their inception.

BRC-20s have caused Bitcoin transaction fees to spike at times in the past year, with fees making up 74% of the block reward at one point.

The total market cap of the top 10 Bitcoin-based non-fungible tokens (NFTs), including Ordinals and Runes, surged to $1.03 billion, with a daily average trading volume of $2.25 million in May 2024.

Source: Binance Research

Source: https://www.binance.com/en/research/analysis/the-future-of-bitcoin-2-tokens

As of June 2024, here’s how activity on Bitcoin is distributed among simple transactions, BRC-20, Ordinals/Inscriptions, and Runes:

We’re also seeing major players in the ecosystem getting increasingly involved in the Bitcoin degen universe. A recent example is Arthur Hayes with the Airhead project: Airhead by Arthur Hayes.

In addition to these three new concepts, more and more projects are being built around Bitcoin. The most well-known and recent example is Babylon (which raised $88M), the equivalent of EigenLayer for Bitcoin, allowing Bitcoin to be staked to secure PoS chains. Other restaking projects on Bitcoin, such as Lombard Finance, are also emerging. We’re also seeing key players from the EVM and Solana ecosystems gradually moving onto Bitcoin, such as the Phantom and OKX wallets, as well as the Jumper bridge aggregator.

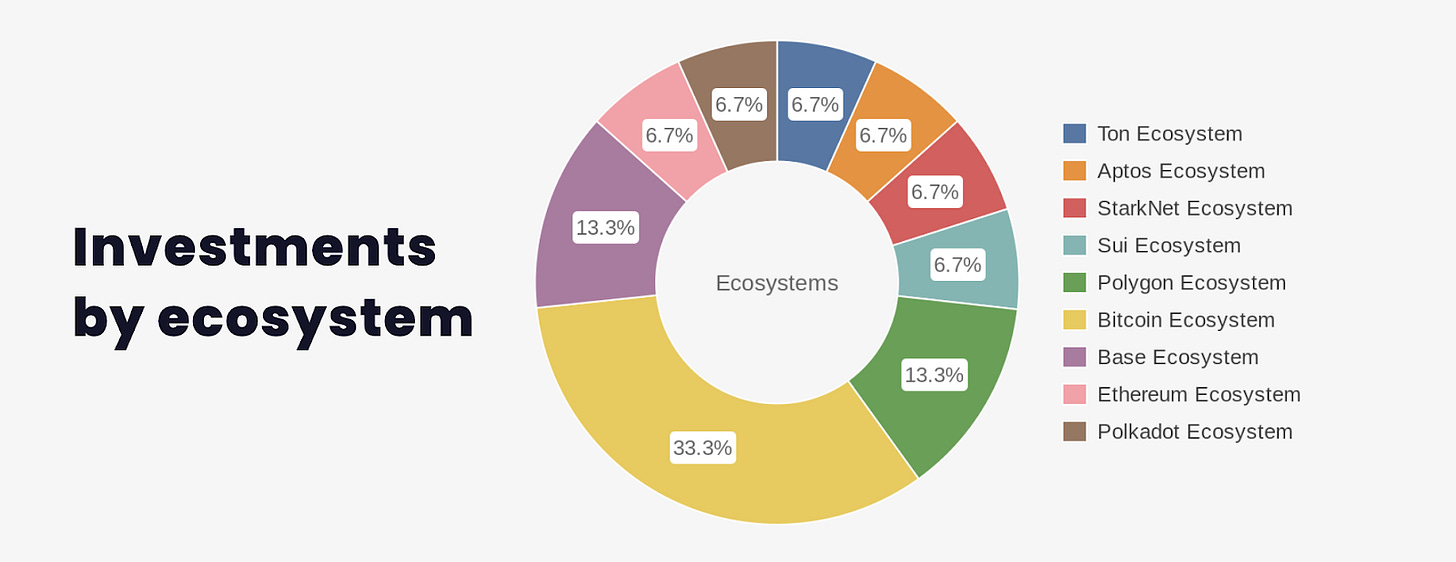

Lastly, significant investments are being made in the Bitcoin ecosystem:

Source: https://crypto-fundraising.info/blog/dates-18-24-aug-2024/

As you can see, Bitcoin, which already had scalability issues with simple transactions, is seeing these problems intensify with the rise of new activities. L2s have the potential to solve these problems while bringing more expressiveness to Bitcoin, enabling DeFi activities like lending/borrowing, perpetual trading, stablecoins, and more—all using native BTC.

It’s time for Bitcoin to adopt general-purpose L2s (different from the Lightning Network, which is only suited for simple transfers).

4. The Bitcoin L2 landscape and OP_CAT as a potential savior

Some may say there are already general-purpose L2s on Bitcoin. Technically true, but only on paper. There are indeed some promising projects, like Citrea or Alpen, working on building L2s for Bitcoin, but as of now, there isn’t a fully functional general-purpose L2 live on Bitcoin. Anyone claiming otherwise is either promoting a scam 😉 or talking about sidechains (such as Rootstock and Stacks). The reality is that we still don’t have a ready-to-deploy Bitcoin rollup.

However, ongoing research and development within the Bitcoin community are bringing us closer to a future where Bitcoin rollups aren’t so far off. Let's start with a quick look at the three most important Bitcoin upgrades that lay the foundation for rollups.

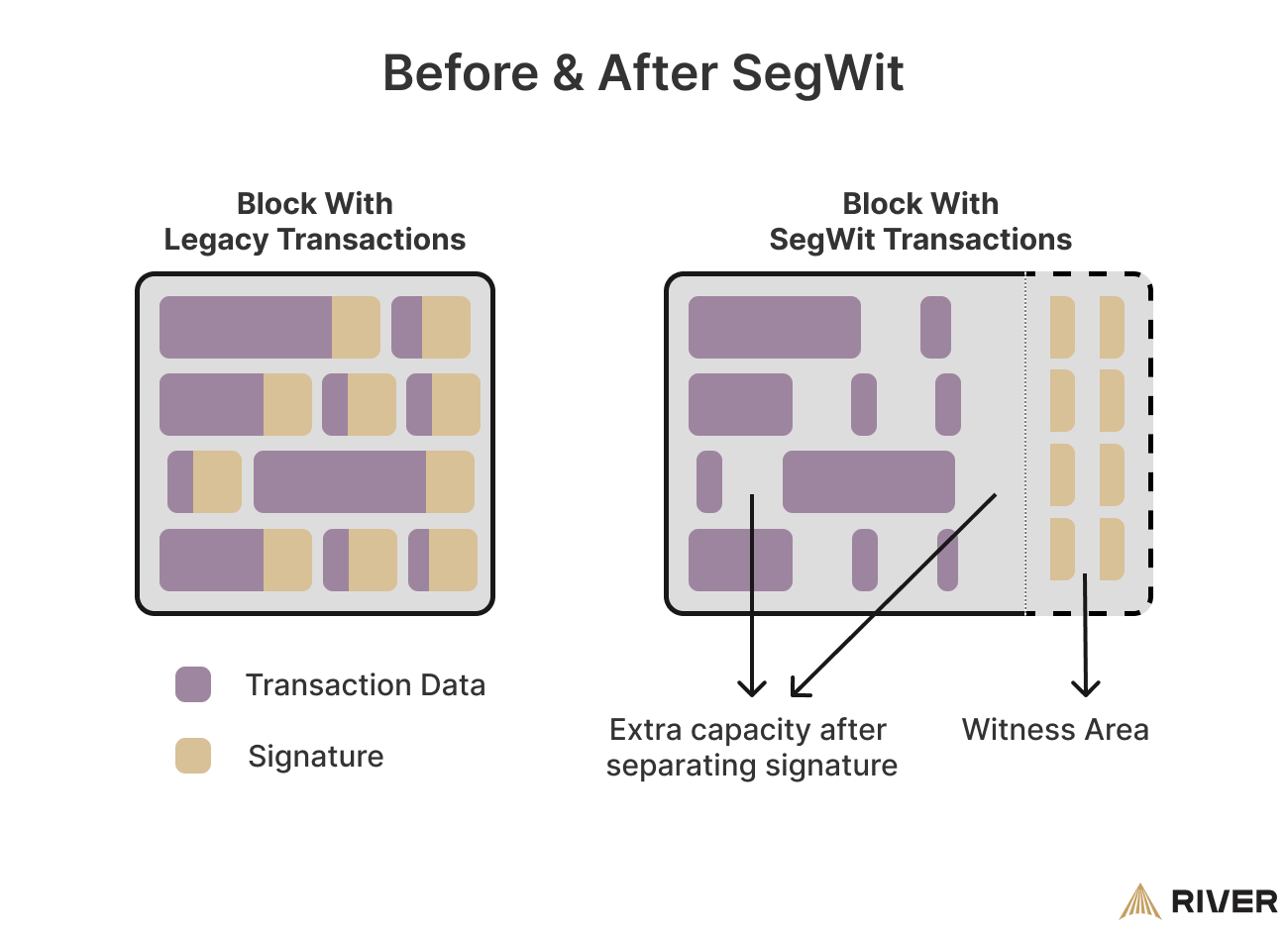

First, SegWit, implemented on Bitcoin in 2017, introduced several features that make rollups more feasible:

Signature separation: SegWit separates signatures from transaction data, freeing up space within blocks. While this doesn’t change the physical block size, it allows for better use of available space, enabling more transactions to fit. This is especially beneficial for rollups because it lowers the cost of including compressed transactions in Bitcoin blocks.

Reduced transaction malleability: Before SegWit, it was possible to change a transaction's identifier without invalidating its contents. This made it difficult to create dependent transactions, as changing the identifier would invalidate linked transactions. SegWit solves this by calculating the transaction ID without including signatures, making it easier and more secure to implement smart contracts and bridges between Bitcoin and L2s.

More complex scripts: SegWit allows for more complex scripts without increasing transaction size, enabling advanced functionality without proportionally higher transaction fees.

Source: https://river.com/learn/what-is-segwit/

The second key upgrade is Taproot, activated on Bitcoin in 2021. Taproot brought several crucial improvements for rollups:

Privacy enhancement: Taproot enhances privacy through MAST (Merkelized Abstract Syntax Trees) and Schnorr signatures. Unlike traditional smart contracts, where all conditions are visible, MAST only reveals the relevant parts of a contract, thus increasing privacy. On its side, Schnorr signatures aggregate multiple signatures into one, making multisig transactions indistinguishable from ordinary Bitcoin transactions. For rollups, MAST helps hide specific proofs and conditions, revealing only the essentials to validate aggregated transactions. Schnorr signatures combine different signatures into a single one, making the final rollup transaction lighter, cheaper, and harder to distinguish from a regular Bitcoin transaction.

Space optimization: Taproot optimizes space within blocks by making transactions more compact, reducing both their size and cost (as explained in the previous point)

Increased security: Schnorr signatures offer security advantages over the previously used ECDSA signatures, eliminating issues like signature malleability and improving the security of complex transactions (e.g., multisigs). MAST enhances security by reducing the attack surface, as only the conditions relevant to validating a transaction are revealed. This combination makes rollup proofs more secure.

Improved interoperability: Taproot ensures that complex transactions are indistinguishable from simple ones, making interoperability between different transaction types easier.

Source: https://k33.com/research/archive/articles/what-is-taproot-the-next-bitcoin-upgrade

Lastly, we have OP_CAT, an opcode at the heart of much debate within the Bitcoin community. OP_CAT allows for the concatenation (joining) of two elements on the Bitcoin Script execution stack. Initially disabled by Satoshi for security reasons (due to memory overload and DoS attack risks), OP_CAT could now be reintroduced safely, notably thanks to SegWit and Taproot improvements. OP_CAT is crucial for creating ZK/Validity rollups on Bitcoin, as it simplifies the creation of covenants needed for proof verification.

More precisely, OP_CAT addresses a fundamental limitation in Bitcoin Script, a language split into two:

Small Script: Allows manipulation of elements 4 bytes or smaller.

Big Script: Enables cryptographic operations (like hashing) or handling larger elements, but without the ability to manipulate them directly.

Reintroducing OP_CAT would bridge this gap, uniting small and big script functionalities, which together offer two major advantages:

Enhanced smart contract capabilities: OP_CAT, in conjunction with the "Schnorr trick" (an innovation introduced by Poelstra that leverages digital signature opcodes), would enable state storage and the development of more complex smart contracts on Bitcoin.

STARK implementation: The ability to concatenate strings and hash them efficiently would open the door to implementing STARKs on Bitcoin, a critical component for STARK-based Validity Rollups (such as Starknet 👀).

Here is a great website explaining OP_CAT: https://opcat.wtf/

In brief, the potential reintroduction of OP_CAT would allow efficient verification of STARK proofs on Bitcoin, enabling true Bitcoin scalability. Simply put, with OP_CAT, Starknet can scale Bitcoin. This reintroduction would require a soft fork, needing the approval of the Bitcoin community. A proposal, BIP-347 (formerly BIP-420), has already been put forward in this regard.

It’s also important to mention BitVM’s efforts in researching true scaling solutions for Bitcoin. BitVM is a new model for executing Turing-complete contracts (in theory, capable of solving any computational problem) on Bitcoin; though Bitcoin has already some form of smart contracts, they are very limited.

In simplified terms, BitVM enables off-chain (L2) transaction execution and the ability to verify these on Bitcoin using a dispute window with fraud proofs. This allows the creation of trust-minimized Optimistic Rollups by introducing fraud proofs and a challenge-response protocol on Bitcoin. Unlike OP_CAT, BitVM doesn’t require any changes to Bitcoin, meaning it can be deployed without any protocol modifications.

I won’t delve deeper into it here, as Optimistic Rollups have many drawbacks compared to Validity Rollups (dispute periods, security based on game theory rather than mathematics, bridge issues, etc.). Given Bitcoiners' justified maximalism on security, Validity Rollups are better suited to Bitcoin than Optimistic Rollups. However, interesting hybrid structures (combining Fraud proofs and Validity proofs) may emerge with BitVM.

Once again, neither Optimistic Rollups nor ZK/Validity Rollups are yet live on Bitcoin as of September 2024. Teams claiming otherwise fall into one of three categories:

Sidechains, like Stacks and Rootstock.

Those developing in anticipation of future feasibility, such as StarkWare, Citrea (which uses BitVM for onchain fraud proofs for its ZK-proofs), and Alpen.

Scams.

The best solution in terms of performance and security seems to be the creation of a Validity Rollup powered by OP_CAT, and Starknet is currently the best-positioned project in this category. Let’s see why 🧑🔬

Part II: Why Starknet can be the best option to scale Bitcoin

1. Wait wtf, Starknet on Bitcoin? Isn’t It an Ethereum L2?

Yes, anon, Starknet is currently a L2 for Ethereum and will remain so in the future. However, Starknet wants to accomplish something no other L2 has ever done—or even imagined in the industry: scaling both Bitcoin and Ethereum with the same layer.

This vision was announced by StarkWare on June 4th, positioning Starknet, once again, as a precursor. Starknet, the first general-purpose Validity Rollup in production, the first altVM L2, the first L2 to offer Parallel Execution on Mainnet, first and only fully AA-based ecosystem, the first and only L2 with cross-chain proof aggregation and potentially soon… the first L2² 🤯.

So, if OP_CAT gets reactivated on Bitcoin, Starknet could potentially become a L2 for both Ethereum and Bitcoin at the same time. In fact, this might even be possible without OP_CAT 👀

Source: https://x.com/GuthL/status/1829155028478898416

So it’s important to understand that Starknet will continue scaling Ethereum. Below is Starknet's optimization roadmap for that, and it's already one of the fastest L2s (with 2-second confirmation times for most transactions), the cheapest ($0.002 per transaction), and with a transaction capacity that’s constantly increasing (currently 400 TPS, with the potential to exceed 1,000 TPS by the end of the year imo).

Source: https://x.com/Starknet/status/1821214190402666704/photo/1

Thus, StarkWare does not plan to fork Starknet to create an exclusive layer for Bitcoin or launch a new token for the Bitcoin ecosystem. Instead, StarkWare aims to extend Starknet into an L2 capable of operating on two blockchains (and possibly more in the future—could this be the real vision of L0s? 👀). The security, governance, and ecosystem will remain fully governed by the STRK token, meaning StarkWare's and Starknet's innovations will benefit both the Ethereum and Bitcoin ecosystems equally.

As such, Starknet is about to reshape the narrative forever—from Ethereum vs. Bitcoin to Bitcoin and Ethereum working together, making Starknet the unifying layer for the two most important ecosystems in the crypto world:

Yesterday: STARK proofs for the win of Ethereum.

Today: STARK proofs for the win of Ethereum AND Bitcoin

And this isn’t just an opportunistic move. Not at all. Bitcoin and Ethereum are the two ecosystems that offer the most security and decentralization. Starknet has always aimed to scale the ecosystems that made the most sense, building an integrity layer to protect users' freedom. Scaling Bitcoin is the natural next step for Starknet. It’s also worth noting that Eli, StarkWare's CEO, was already talking about scaling Bitcoin with ZK proofs back in 2013 at a Bitcoin conference. So yes, StarkWare has had this vision of scaling Bitcoin for a long time. But back then, Bitcoin wasn’t ready for Validity Rollups. Now it is. And StarkWare, through Starknet, is best positioned to make it happen 🧑🔬

2. StarkWare: a scaling giant

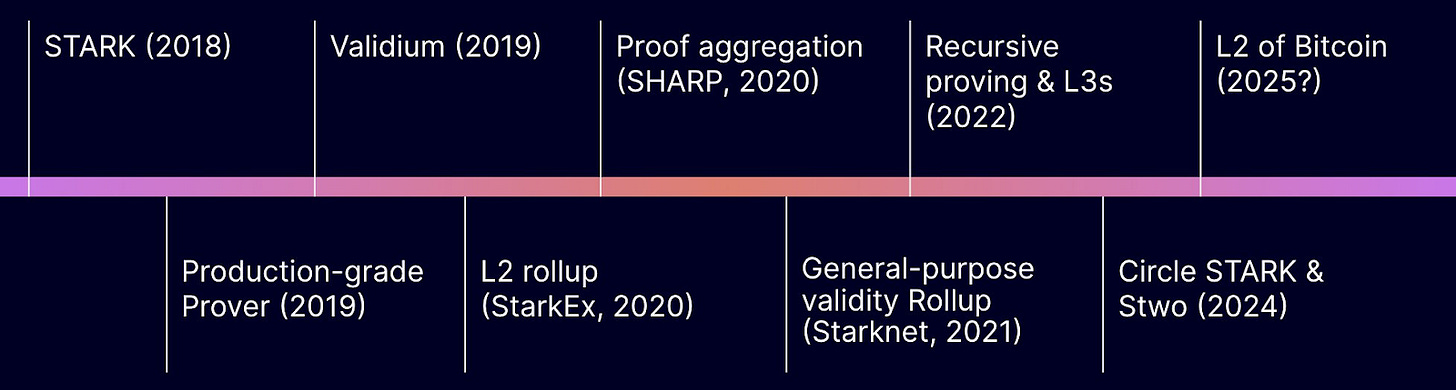

StarkWare, the team behind Starknet and its main contributor, has been the most innovative force in blockchain scaling, as demonstrated by the numerous breakthroughs it has introduced to the market.

First, StarkWare invented STARK proofs, which are more efficient than SNARKs and are now increasingly adopted by industry leaders, including StarkEx (StarkWare product used by Sorare and dYdX v3), Starknet, Polygon, zkSync, Kakarot zkEVM, Risc0, ZeroSync, Eclipse, Citrea, and many more. What’s particularly interesting is that STARK proofs are highly compatible with Bitcoin; their hashing-based calculations align well with Bitcoin’s native operations, allowing for an efficient implementation of STARK-based Validity proofs on Bitcoin without major infrastructure changes (except for OP_CAT). And who better than their creators to integrate them on Bitcoin? 😏

In short, STARK (Scalable Transparent ARguments of Knowledge) is a cryptographic proof system designed to scale blockchains (and bring privacy in the future) through Validity Rollups (and ZK Rollups in the future). The two primary proof systems in use today are SNARKs and STARKs, but STARKs offer several key advantages: they don't require a trusted setup (making them more flexible and secure), are resistant to quantum attacks, and generate faster proofs as computation complexity increases. STARKs outperform SNARKs, especially in large-scale systems or complex computations, making them ideal for applications that demand massive calculations and for enabling the famoso mass adoption. In summary, STARKs offer superior security, transparency, and scalability, which is why the industry is increasingly adopting them.

Another key point is that STARKs are the most battle-tested technology in the industry. StarkWare launched the first Validity Rollups based on this technology:

June 2020: StarkWare, through StarkEx, launched the first app-specific Validity Rollups. This technology powers industry giants like Sorare, dYdX v3, Immutable, RhinoFi, and more. Here are the metrics since:

Source: https://starkware.co/starkex/

November 2021: StarkWare launched the first general-purpose Validity Rollup in the industry: Starknet. Here’s a great video series showing how Starknet efficiently scales Ethereum using STARKs and Validity Rollups: How Starknet Scales Ethereum.

In summary, StarkWare invented STARK proofs, which are now the most effective scaling technology on the market and are being increasingly adopted. StarkWare also has the longest track record in scaling with Validity Rollups. Remember, STARK proofs are particularly suited to Bitcoin, and Validity Rollups are the best scaling solution available. You see where I’m going with this? 👀

By bringing a STARK-based Validity Rollup to Bitcoin, the Bitcoin community could finally enjoy the same benefits as Ethereum: a scalable chain (low cost, fast, and with ever-increasing TPS capacity) with infinite expressiveness (complex smart contracts), all while maintaining Bitcoin’s security and decentralization.

Source: Token Terminal

In addition, StarkWare has introduced several concepts that other scaling firms are now adopting. A few examples:

StarkWare introduced the idea of cross-chain proof aggregation, allowing cryptographic proofs from multiple chains and applications to be aggregated and submitted as a single proof to the L1, optimizing scalability and efficiency. Starknet is currently the only ecosystem with cross-chain proof aggregation in mainnet (via SHARP). Many ecosystems are now working to integrate similar systems.

In 2021, StarkWare introduced the concept of fractal scaling, where additional layers are built on top of L2s, and further layers on top of those. This is the L3 concept that everyone is talking about today.

While many focused on the EVM, StarkWare was the first to create an altVM L2 with its own programming language optimized for ZK proofs: Cairo. Here’s a short video on why altVM L2s are superior to EVM-compatible L2s.

In addition to launching the very first production-grade prover in 2019 (a critical component for Validity Rollups), StarkWare is now introducing a next-generation prover, which is 1,000 times more efficient than the one currently used by Starknet. This new prover, called Stwo, is by far the most efficient on the market, outperforming others by a factor of 100. It will be deployed across all Starknet-powered chains by Q1 2025, significantly improving the validation time and cost of proofs on these chains. More details here.

Now, StarkWare is positioning itself as the first to announce an L2² vision, aiming to scale two blockchains at once (and opening the door for more in the future).

Source: https://x.com/StarkWareLtd/status/1813159596514812216

In conclusion, StarkWare has brought more innovation in scaling than any other company, and there’s no close second. Soon, the Bitcoin ecosystem will also benefit from this expertise and these innovations. In fact, StarkWare is already actively working on scaling Bitcoin, with significant progress already made.

Source: https://starkware.co/scaling-bitcoin-with-starks/

3. StarkWare’s current work on Bitcoin

On June 4, 2024, StarkWare unveiled its new vision, and in just three months, significant progress has already been made.

Before diving into these advancements, it's important to note that StarkWare has been involved in the Bitcoin ecosystem long before this announcement. Notably, CEO Eli Ben-Sasson introduced the concept of scaling Bitcoin via ZK proofs at a Bitcoin conference back in 2013. StarkWare has also supported and funded various Bitcoin-related projects, including ZeroSync, which pioneers ZK proofs for enhancing Bitcoin’s privacy and scalability, as well as @QEDProtocol, @BitlayerLab, and others. Additionally, StarkWare commissioned the “Validity Rollups on Bitcoin” report by researcher John Light. So, StarkWare’s relationship with Bitcoin has been building for quite some time, and this collaboration is now accelerating.

One major step is the creation of a $1 million research fund dedicated to OP_CAT, aimed at financing initiatives that explore the potential benefits and risks of reactivating this opcode on Bitcoin. As explained in Section I.4 of this article, OP_CAT could greatly facilitate the creation of Validity Rollups on Bitcoin. However, this opcode was disabled by Satoshi over a decade ago for security reasons. With advancements like Taproot, these concerns are less relevant today, though some in the Bitcoin community remain cautious. While OP_CAT now appears to be secure, it could theoretically introduce new attack vectors. The research fund's goal is to accelerate studies to better understand these risks (if they really exist). More details on the fund and how to apply: StarkWare - Submission Proposals.

In terms of research, StarkWare has also published the most practical covenant-rollup research ever released: General Computation on Bitcoin.

But StarkWare’s efforts don’t stop at theory. On the practical side, in collaboration with @l2iterative and @weikengchen, they launched the Stwo Verifier on Bitcoin Signet (a Bitcoin test network with OP_CAT activated), and verified the first STARK proof in Bitcoin Signet's history. More details here.

In just six weeks, this major milestone was achieved, solidifying StarkWare as a pioneering player. It also demonstrates that the Stwo prover (introduced earlier) is perfectly suited for Bitcoin. Additionally, StarkWare has found a way to optimize verification costs on Bitcoin, reducing multiplication costs by 70%. Again, more details here. A bounty will soon be launched to push further optimizations.

StarkWare has also announced a partnership with sCrypt to build a PoC bridge based on OP_CAT covenants and ZK proofs, aimed at overcoming technical challenges related to building a canonical Bitcoin <> L2 bridge. StarkWare’s exploration team is also working on other projects, including Shinigami, a Bitcoin Script VM in Cairo that generates STARK proofs for general computations on Bitcoin Script. Here are the results in just two months.

Lastly, two other StarkWare initiatives are worth mentioning, although they’re not directly related to Bitcoin. The first is Starknet decentralization, a crucial point for the Bitcoin community. The first step has already begun, with community voting on STRK staking parameters and the gradual transition of Starknet into a fully decentralized PoS network. While this will take time, STRK staking is expected to begin by Q4 2024, a first for any L2. Improvements are still needed, such as implementing an escape hatch for L1 withdrawals in case of downtime or censorship, and improving Starknet’s classification on L2Beat (currently considered a Phase 0 Rollup, the lowest classification). The vision of launching Starknet on Bitcoin will likely accelerate these decentralization and security improvements.

The second initiative is Volition, a model offering hybrid data availability solutions on the layer, allowing dApps to choose where to settle their transactions: on Ethereum for maximum security but higher cost, or on a cheaper but less secure solution. Although the exact form of Starknet’s launch on Bitcoin is still unknown, it’s possible that a Volition model will be implemented for Bitcoin, allowing developers to choose between Ethereum or Bitcoin for transaction settlement. Volition is on Starknet’s roadmap, and while the timeline isn’t precise, it’s likely to arrive in 2025.

4. Wen wen wen

This section will be brief, as the exact timeline remains uncertain. It largely depends on the Bitcoin community’s stance on OP_CAT. Given the community's usual caution with changes (only two soft forks—Segwit and Taproot—in the past seven years), the process could take some time. StarkWare has committed to launching Starknet on Bitcoin within six months of OP_CAT being reactivated.

Whether it happens now or in three years, StarkWare, through Starknet, is best positioned to bring Validity Rollups to Bitcoin. This integration would bring significant benefits to both ecosystems... Let’s explore those now.

Part III: Benefits for both ecosystems

1. For the Bitcoin community

The most obvious benefit for the Bitcoin community is that they would finally have a scalable environment where BTC can be used for more than just holding. Users could notably make regular payments, both small and large, with greater ease than through the Lightning Network. They would also gain access to the full range of DeFi activities and exposure to the Ethereum ecosystem, all while maintaining Bitcoin’s security and decentralization. The key here is the use of native BTC, which is crucial since the Bitcoin community doesn’t use wrapped tokens (such as wBTC) that involve centralized intermediaries—less than 1% of all Bitcoin is currently used in other ecosystems.

Starknet can bring all of this to the Bitcoin community by offering a highly scalable environment. Here are Starknet’s current metrics:

Average transaction fee: $0.002

Confirmation time: 2 seconds for most transactions

TPS capacity: Increased from 5 in 2023 to 400 today, with a potential to exceed 1,000 TPS by the end of the year.

Source: https://x.com/Starknet_OG/status/1831263276556320825

In addition to scalability, Starknet offers a much-improved UX thanks to its native Account Abstraction and smart wallets such as Braavos and Argent X. Some unique features already available on Starknet include:

Multicall: Execute all necessary operations in one transaction (e.g., providing liquidity to an AMM pool in a single tx instead of three separate ones).

Session Keys: Sign once for a set period or a specific asset (e.g., 30 minutes without needing to sign again or up to 0.1 ETH in gas fees), particularly useful for gaming applications.

2FA and 3FA on wallets: Enhanced security through additional authorizations, so even if someone gains access to your seed phrase, he can’t steal your funds.

Limited Approval: dApps can only access the exact amount needed for a transaction, not a penny more, unlike unlimited approvals, which have led to millions in losses on other ecosystems.

Daily Spending Limit: Set a daily spending limit on your assets.

Paymaster: Pay gas fees with any token.

And that’s just the beginning. New UX innovations are on the way, with Starknet aiming to make gas fees so low, and developing Paymaster, that projects themselves could subsidize these fees for their users—similar to how Web2 giants like Facebook cover infrastructure costs. Around 15 projects already use the Paymaster on Starknet, and with gas fees around $0.002 per transaction, what seemed impossible just a year ago is now becoming a reality. This leap in UX could greatly benefit the Bitcoin community.

Through Starknet, the Bitcoin community would also gain access to Ethereum’s innovations, such as DeFi, NFTs, gaming, and more. While Bitcoin users would unlock a wide range of crypto use cases, Ethereum users would benefit from Bitcoin's liquidity. It’s a win-win situation that could be realized on Starknet.

In short, Starknet could provide the Bitcoin community with a scalable, expressive environment with a Web2-like UX, all while retaining Bitcoin’s security and utilizing native BTC.

It’s also worth noting that Bitcoin lacks an expressive programming environment. This limits its appeal to developers, who are crucial for infrastructure and dApp innovation. Starknet, on the other hand, has a vibrant developer community and a much more powerful programming language, Cairo, which is far more expressive than Script and more efficient than Solidity. Cairo, open-source and Rust-based, allows for dApps that are impossible to build with other languages, which could attract more developers and applications to Bitcoin.

While Bitcoin struggles to attract new developers, Starknet’s developer community is growing rapidly, with one of the fastest expansions in recent years.

Source: https://www.developerreport.com/

While many L2 solutions focus solely on EVM compatibility, Starknet built its own language optimized for performance. As other EVM-based L2s risk cannibalizing each other, Starknet offers a unique and innovative environment. This gives Starknet a unique position in the Bitcoin ecosystem. It is important to note that EVM developers will also have a place on Starknet thanks to Kakarot, which will make Starknet the first ZK dualVM in Q4 2024, allowing Solidity developers to deploy their dApps alongside Cairo developers.

Bitcoin will also need to motivate developers to migrate from other ecosystems and attract users to its L2 ecosystem for greater visibility and adoption.

For Bitcoin users, this means a strong commitment to security and decentralization from L2s. Starknet has already started its decentralization process, with community voting on STRK staking parameters and the progressive shift to a fully decentralized PoS network. Other ‘classic’ users may need incentives like airdrops or broader campaigns to join the ecosystem. Well, Starknet has already announced several upcoming airdrops and is running campaigns like DeFi Spring. Furthermore, we need killer dApps to really attract users. Starknet already offers unique dApps, such as Ekubo, the most efficient AMM on the market, Nimbora the first DeFi pooling application, Braavos & Argent, the most advanced smart wallets, Influence, a next-gen fully onchain game, and many more. Starknet’s Foundation and the StarkWare BD team are actively working to onboard more.

On the developer side, we’ll need to motivate them to learn a new programming language: Cairo. I’m confident that Starknet has everything it takes to attract a large number of devs, as the trends in the previous graph indicate. Why? Because Cairo enables the creation of dApps that would be impossible to build with other languages, Starknet is pioneering and innovating on multiple fronts, and soon, it will bring together the Ethereum and Bitcoin communities. Not to mention the significant incentives available (Seed Grant program, Catalyst program, Propulsion program, DP of StarkWare, etc.).

Lastly, one of Bitcoin's main long-term challenges is the gradual reduction of block rewards, which are halved ~ every four years through the halving process, decreasing the incentive for mining. While the value of Bitcoin is expected to increase between halvings to compensate for this reduction, it remains a risky bet. Additionally, once the 21 million Bitcoin cap is reached (around 2140—yes, there’s still time), there will be no more block rewards to incentivize securing the network. At that point, transaction fees will need to be high enough to compensate for the lack of mining rewards.

User-driven activity, such as what we’ve seen with Ordinals, BRC-20, and Rune, along with the use of L2s, offers a solution by generating additional revenue for miners. While activity on the L1 directly affects usability by increasing fees and congestion, L2s allow users to benefit from Bitcoin’s security in a fast, low-cost environment, while still generating revenue for miners. In a few years, Bitcoin may be primarily seen as a settlement layer for L2s, with most executions happening on these secondary layers, as is already the case with Ethereum.

Another advantage worth highlighting is the privacy that ZK technology could bring to Bitcoin. Although “ZK” Rollups are currently only Validity Rollups (with a few exceptions like Aztec, which is not yet in production), ZK technology—used today to optimize scalability—could, in the future, incorporate privacy features. Imagine Bitcoin with an additional layer of privacy (this could notably attracts the Monero fam) 🤯

The advantages of Starknet becoming a L2 for Bitcoin are numerous and significant for the entire community: scalability, expressiveness, growth of the Bitcoin ecosystem, a major leap in UX, enhanced security, and eventually, privacy. And the benefits for Starknet are just as considerable.

2. For the Starknet community

The benefits for Starknet are simply… incredible. Not only will Starknet position itself as a L2 for Bitcoin, but it will also become a unifying layer between Bitcoin and Ethereum, scaling both ecosystems simultaneously on the same layer.

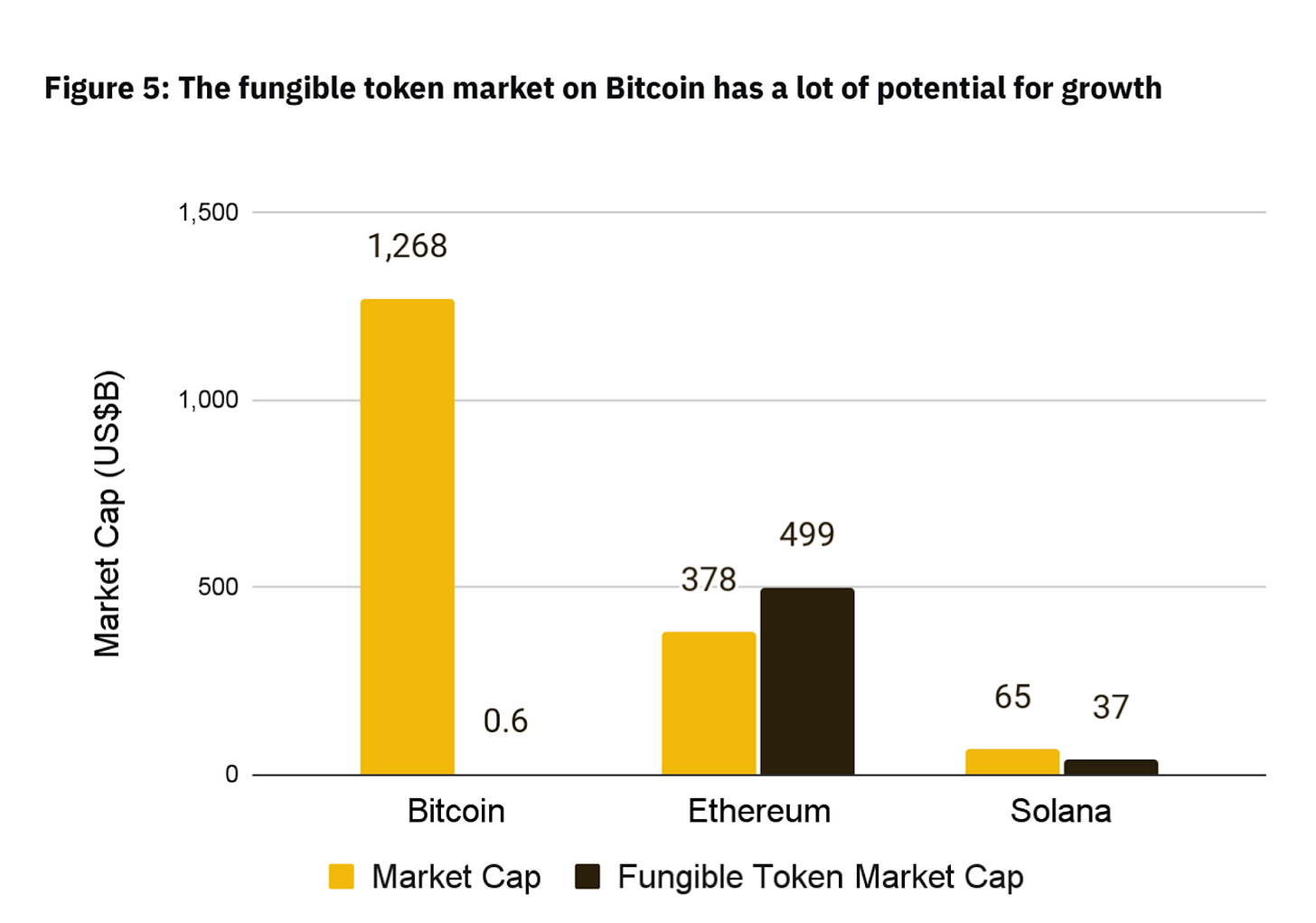

In this way, the Starknet community will benefit from innovations in both ecosystems, while the Bitcoin and Ethereum communities will mutually benefit from each other’s advancements—all on Starknet. For example, ERC-20, ERC-721 (NFTs), Ordinals/Inscriptions, BRC-20, and Runes could all exist natively on the same layer, interacting seamlessly. And tokens originating from Bitcoin are just beginning, with a massive potential for growth.

Source: Binance research

With a trustless bridge between Ethereum <> Starknet and Starknet <> Bitcoin, all while settling on both L1s, Starknet will greatly enhance the interoperability between the two largest crypto ecosystems. This improved interoperability could lead to a surge of liquidity and TVL flowing from Bitcoin to Starknet, while also attracting more liquidity from Ethereum. The latest because the Ethereum community will have even more reasons to join Starknet to access the liquidity and new community brought by Bitcoin.

The liquidity potential that Bitcoin can bring to a layer like Starknet is enormous, especially since this liquidity is still underutilized. Let’s quantify this by looking at Ethereum and its L2s as of September 10, 2024:

ETH: $284 billion market cap, $34 billion on L2s, which is about 12% of Ethereum’s market cap.

Project this onto Bitcoin: BTC, with a $1.1 trillion market cap, 12% on L2s would represent a potential $132 billion. Given that the Bitcoin community may be more hesitant to use their BTC in DeFi, even cutting this number in half (6%) would still represent twice the current total TVL of Ethereum.

Consider Arbitrum, the leading L2 by TVL on Ethereum, with $13.5 billion in TVL, accounting for almost 40% of Ethereum L2 TVL. If Bitcoin follows a similar pattern, the leading L2 could attract over $50 billion in TVL (with 12% of Bitcoin’s market cap), or $25 billion with just 6%.

In short, while these are theoretical projections, the liquidity potential is massive. While it’s impossible to say for sure if Starknet will be the leading L2 by TVL, you can admit that it will hold a unique position in the landscape of Bitcoin (and Ethereum) L2s.

Another advantage, common to all Bitcoin L2s, is the visibility Bitcoin brings to an ecosystem—not just among crypto Twitter nerds like us, but to "normies" and institutions. Bitcoin is the flagship of Web3, the most talked-about asset in traditional circles: Bitcoin ETFs (which far outperform Ethereum ETFs so far), growing interest from giants like Blackrock, and overwhelming media coverage. The traditional sphere’s interest has never been stronger, and there’s enormous potential to onboard these new users (normies and institutions). Bitcoin L2s will benefit from this network effect. Now, imagine a world where these new users, onboarded by Bitcoin, start using applications developed by the Ethereum community on Starknet 🤯

Indeed, the vision of a layer unifying two ecosystems has the potential to attract a flood of new users and TVL to Starknet. Furthermore, this unification will bring significant advantages and new use cases for Starknet users and developers:

Managing native Bitcoin and Ethereum assets in self-custody on the same layer, using the same Starknet smart wallet (which offers far superior UX and security compared to traditional wallets).

Using these native Bitcoin and Ethereum assets together for DeFi, NFTs, gaming, degen activities, and more.

Leveraging Bitcoin and Ethereum assets to strengthen DeFi protocols that require substantial TVL to function efficiently. Imagine using BTC and ETH as collateral for long/short trading, or a stablecoin like Ethena backed by native BTC and ETH. The potential is immense.

Atomic swaps between BTC/ETH (ELI5: trading BTC/ETH and related assets without needing a centralized intermediary).

Additionally, if a Volition-type system is implemented, it would offer more options to developers and projects. They could choose the consensus they prefer for securing their dApp transactions: Bitcoin’s PoW (objectively more secure than PoS) or Ethereum’s PoS.

And much more.

More options, diversity, use cases, and potential mean more developers and users, especially since they’ll be incentivized through programs like DeFi Spring, Seed Grant, Catalyst, and others.

If OP_CAT is reactivated, Starknet could become the platform where two distinct ecosystems interact on the same layer, using the same self-custodial wallet to access all that crypto has to offer. As Eli Ben-Sasson aptly said, this increases the likelihood of success for our mission:

“This increases our likelihood to succeed in building protocols that can resist nation-states.”

Eli Ben-Sasson

Conclusion

StarkWare’s ambition to scale both Bitcoin and Ethereum simultaneously through Starknet marks a pivotal moment in the evolution of Web3. While this vision hinges on the reactivation of OP_CAT on Bitcoin, StarkWare’s progress suggests enormous potential. If realized, this vision could not only revolutionize both ecosystems but also pave the way for limitless multi-chain scalability.

Imagine a future where a single layer can scale multiple blockchains, providing Bitcoin, Ethereum, and potentially other L1s with a shared solution to improve scalability and interoperability while maintaining security and decentralization. This would be a giant leap forward for Web3, and Starknet is well-positioned to make it happen. If it works for Bitcoin and Ethereum, why not expand this model to other L1s in the future? The potential becomes nearly infinite.

This is no small challenge, but StarkWare has already proven time and time again that they are pioneers in scaling, consistently turning innovative ideas into reality. Successfully uniting these two giants on a single layer would be a historic first, both technically and philosophically.

On a broader level, this integration would finally achieve what many in the crypto ecosystem have long dreamed of: a decentralized platform enabling economic interaction between the Bitcoin and Ethereum communities, all while preserving their fundamental values and principles. It would mark the end of the traditional Bitcoin vs. Ethereum narrative, transforming it into a harmonious collaboration of Bitcoin and Ethereum together.

In conclusion, with this new scaling approach and Starknet’s innovative tools, Bitcoin could finally reach an unprecedented level of financial inclusivity. These advancements would better equip Bitcoin to provide millions of unbanked people around the world with access to a global, secure, and truly decentralized financial system. The potential is massive, and Starknet could very well be the key that unlocks this new era for Web3.

As Peter Thiel highlighted with the concept of the "10x rule," it’s not always the best technology that wins the market, but an innovation that offers a radical improvement—by a factor of ten—is poised to triumph. This is exactly what Starknet is building and delivering.

If you notice any errors or misconceptions, feel free to contact me on X—I’d be happy to discuss and fix them!

Big thank you to Victor Kolobov and Adrien Lacombe for the overall review 🫂

Uncited Sources

https://public.bnbstatic.com/static/files/research/the-future-of-bitcoin-2-tokens.pdf

https://public.bnbstatic.com/static/files/research/the-future-of-bitcoin-3-scaling-bitcoin.pdf

NFA, DYOR.