STRK staking: A major step toward Starknet’s full decentralization

Why STRK staking is a big deal for Starknet’s future, and how you can make the most of it

STRK staking has been live on Starknet since November 2024, making it the first L2 to introduce a permissionless staking mechanism directly on L2. This marked a major milestone for Starknet, as STRK holders finally gained a real advantage, the STRK token acquired a new utility, and, most importantly, Starknet officially began its transition toward full decentralization.

In its final form, STRK stakers will fully govern the network and be rewarded not only with STRK staking rewards but also with fees generated by the network.

In short, this is a fucking big deal, and once again, Starknet is leading the way.

Follow me in this article to learn everything you need to know: what STRK staking is, where to stake, the best yield routes, and how to make the most of it 🥩

I. STRK Staking: The Big Picture

Starknet was the first Layer 2 to introduce a permissionless staking mechanism directly on L2. The goal? To make Starknet a truly secure and decentralized L2; just as all L2s should strive to be.

On a side note regarding security, and in addition to STRK staking, here are some key points to note:

The Starknet Security Council is coming: SNIP-25: Starknet Security Council v1.0.

Major advances in quantum computing are accelerating potential blockchain threats: the STARK technology powering Starknet is inherently quantum-resistant. More details here.

Implementing all phases of staking will be completed in 2026.

A governance system is already in place, managed by STRK holders.

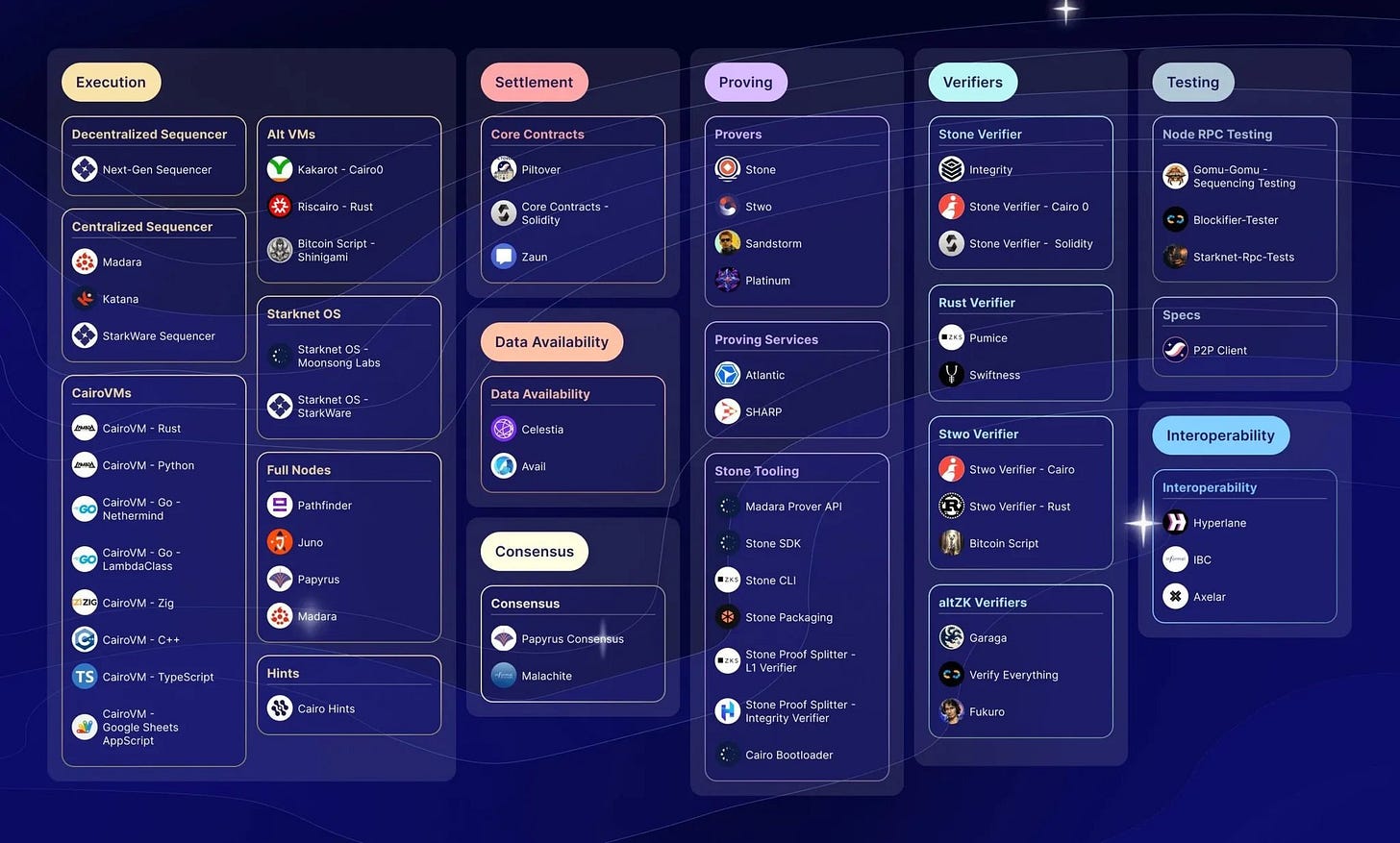

Starknet plans to continue open-sourcing all its core stacks (next ones: Stwo and the new Starknet’s sequencer).

The Starknet Foundation is distributing 1.7B STRK as voting power through an evolving and adaptive mechanism: More details.

Starknet is the only Validity Rollup without a trusted setup (according to L2Beat).

Starknet has by far the most decentralized stack among all L2s (see below).

By putting all of this together, Starknet is steadily moving toward becoming a Stage 1 Rollup on L2Beat (Stage 2 to follow later), truly quantum-resistant once StarkWare prioritizes it (or as soon as quantum risks escalate), and fully decentralized by 2026. Starknet is well on its way to becoming a truly secure and decentralized L2. If you want to learn more about it, check out the full 2025 plan for decentralization.

Refocusing on STRK staking, the current STRK staking phase (1) is just the first step in a much longer plan. This initial phase does not yet provide full security or decentralization, as StarkWare intends to implement staking gradually and carefully.

Why? Because transitioning from a fully centralized to a fully decentralized consensus requires meticulous planning and execution; something no other L2 has done before Starknet.

To draw a simple comparison, it’s akin to Ethereum’s transition from PoW to PoS, a complex process that demands significant effort, experimentation, and time. With over ~$650 millions in liquidity, numerous active projects, and a growing user base, StarkWare has prioritized maximum security throughout this implementation.

In three additional stages, Starknet will achieve full decentralization of its core components, with a decentralized network of sequencers and provers powered by a PoS mechanism. This will allow stakers to earn not only STRK inflation rewards but also user fees in the future.

A buyback and burn mechanism, similar to Ethereum’s, is also a possibility, depending on future community decisions.

For now, the rewards in this first phase come entirely from STRK token inflation, designed to incentivize STRK holders to participate in staking and support StarkWare during this introductory learning phase. However, keep in mind:

This inflation directly benefits the community, as neither StarkWare, the Starknet Foundation, nor any locked tokens can participate in staking at this stage.

The inflation rate is extremely low, with a maximum annualized cap of 1.6%, though in practice, it will likely be much lower. Example: If 75% of the circulating supply is staked (a high estimate, if not impossible given StarkWare and the Foundation cannot participate at this moment), the inflation rate would be approximately ~0.55%. Currently only ~7% of STRK are staked.

As such, this initial phase offers attractive rewards for participants while maintaining an extremely low inflation rate; just the way we (farmooors) like it (NFA, of course).

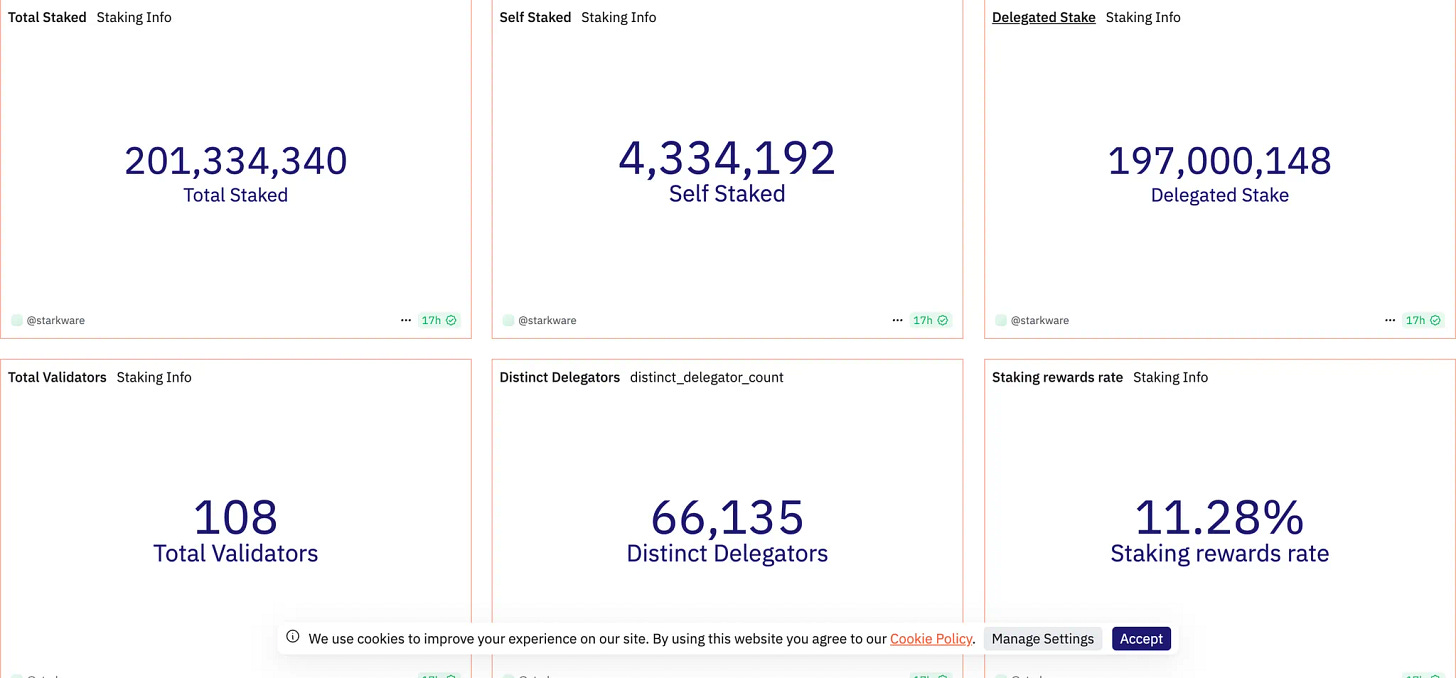

As of 05 March, 2025, over 200 million STRK are staked, and the APR is approximately 11%.

Finally, STRK staking adds a new utility to the STRK token:

✅ Gas fee payments

✅ Governance

✅ One of the few assets incentivized by DeFi Spring for liquidity provision

✅ And now: staking!

II. The full deployment plan

Phase 1: The Foundation

As mentioned above, the first phase of STRK staking, currently live on Mainnet, was designed to gather feedback and test the economic incentives of the staking model. During this phase, anyone can:

Become a validator by running a full node and staking at least 20K STRK.

Become a delegator with no conditions.

After ~3 months of testing, StarkWare has gathered enough data and is now ready to roll out Phase 2, scheduled for Q2 2025.

Phase 2: Strengthening Validator Reliability (Coming Q2 2025)

This new phase has two main goals

Ensure validators can run reliable infrastructure before they take a formal role in consensus (Phase 3).

Improve the economic incentive structure to keep validators profitable long run.

To achieve these two goals, this second phase will introduce two key components.

The first one is Validator Block Attestation: validators will now be required to attest to randomly selected blocks during each epoch. This ensures that validators actively track network activity and prove their reliability.

If a validator fails to attest, they will not receive rewards. Additionally, this will allow delegators to compare validator performance before choosing where to stake.

In short:

Every validator is assigned a block per epoch to attest to.

If they fail to attest, they lose their rewards for that epoch (and so do their delegators).

The second one is commission increase feature. Currently, validators can only lower their commission, which could become problematic if operational costs (hardware, proof generation, etc.) increase.

To address this, validators will now have the option to increase their commission, but only under strict conditions to protect delegators:

Maximum Commission Commitment (M): Validators must predefine a maximum commission they can charge. They will not be able to increase their commission beyond this limit until the commitment period ends. This means validators can only adjust their commission within the range [0, M].

Time-Limited Commitment: Any commission increase must be locked for a set period (up to 1 year). Once the period ends, a new commitment must be made.

Transparency for Delegators: Staking platforms will highlight upcoming commission changes, ensuring delegators are well-informed.

These measures ensure fairness and prevent sudden fee hikes, keeping staking sustainable as Starknet grows.

You can find the full details of these two components here: SNIP-28 Staking v2 Proposal.

The timeline for this new phase is as follows:

A detailed vote explanation has also been published on the Starknet forum.

Test vote (5 days): March 10th–15th, 2025 → This test vote is required because, for the first time, STRK stakers (validators and delegators) will be able to participate in governance.

Official vote (10 days): March 20th–30th, 2025

Q1 2025: Staking v2 deployment on Testnet.

Q2 2025: Staking v2 launch on Starknet Mainnet.

Phase 3 & 4: Full Decentralization of Starknet Operations

By the end of 2025/early 2026, Starknet will take a major step toward full decentralization, transitioning from a single sequencer and prover to a decentralized network of sequencer and prover.

Typically, decentralizing a system leads to performance loss, as coordination between multiple validators introduces latency; a global network of validators must constantly exchange messages, which is inherently slower than a centralized system where a single entity makes all the decisions. Currently, Starknet operates with a single centralized sequencer, but by Phase 3-4 of STRK staking (expected by EOY 2025 - beginning of 2026), the network will transition to a decentralized sequencer and prover network.

In theory, this should slow Starknet down (lower TPS, increased latency). But thanks to Malachite and @informalinc, it won’t! Malachite is a flexible and high-performance consensus engine written in Rust, optimized for speed and reliability. In simple terms, it’s an ultra-fast and efficient consensus mechanism that eliminates the typical trade-offs of decentralization.

According to test results by @informalinc, Malachite:

Can handle ~50K TPS (tested with 10MB blocks).

Achieves ~780ms finalization time even with 100 validators.

Note that the integration of Malachite doesn’t mean Starknet will immediately hit 50K TPS capacity. Other network components (execution, storage, prover) are also limiting factors. However, consensus will no longer be a bottleneck, which is a massive improvement. Thanks to Malachite and staking phase 3-4, Starknet will be:

More robust (one sequencer & prover today vs. over 100 tomorrow).

More decentralized

Still high-performance, with scalability further enhanced by other network upgrades (Cairo-Native, Stwo, etc...).

So, to summarize all of that:

✅ Phase 1: Testing economic incentives.

⏳ Phase 2 (Q2 2025): Validators will need to actively participate to earn rewards, and a commission adjustment feature will allow them to increase their commission, ensuring long-term profitability while maintaining fairness for delegators.

⌛ Phase 3 & 4 (EOY 2025 / Early 2026): Decentralizing the sequencer and prover, without sacrificing performance.

Now, let’s see how you can participate in STRK staking.

III. How to stake?

If you want to participate, anyone can choose to become either a validator or a delegator:

To become a Validator: You need to run a full node and stake at least 20,000 STRK. Here’s how to set up your validator: Staking Setup Guide. You can also find the staking repository here.

To become a Delegator: Simply select a validator to delegate your tokens to—no technical expertise required. User-friendly UIs for delegation are available. More about this below.

This means you can participate in staking even if you don’t have the knowledge or resources to manage the technical infrastructure. If you do have the expertise, setting up your own validator allows you to gather more STRK and collect commission from delegators.

Note that both validators and delegators have a 21-day lock-up period, meaning that once you stake your STRK, it will be locked, and you’ll need to wait 21 days to unlock them. That being said, you can bypass this restriction with Liquid Staking services. So, make sure to consider this before staking, or choose an LST service to stake.

IV. STRK staking Ecosystem

Here are all the projects that support STRK staking:

Wallets:

You can stake directly from Argent, Braavos, and Keplr interfaces.

On Argent, you have the choice to either Liquid Stake through Endur, receiving a liquid staking token (xSTRK), or stake natively. By default, staking natively is delegated to Argent’s validator, but you can change the validator if you prefer.

On Braavos, you can only stake natively through their own validator, which charges a 10% commission on rewards.

On Keplr, you can easily stake and claim your STRK rewards.

Dashboards:

You can track all STRK staking metrics and explore validators using the following dashboards:

Endur.Fi – Track staking metrics, view validators, delegate, and monitor performance.

Voyager – Offers similar functionalities to Endur.

Staking Rewards – Enables direct staking from Ethereum L1 with a few clicks.

Starkscan – A simple validator and staking metrics tracker.

Bonus: The official STRK staking Dune dashboard by StarkWare provides other detailed analytics.

LST Projects:

LSTs allow you to stake STRK and receive a liquid token in return, which can be used in Starknet DeFi. For example, you can earn STRK staking rewards + DeFi Spring rewards by lending on Vesu with Endur’s LST.

As of March 05, 2025, you can achieve 15%+ APY using this simple strategy:

You can earn even more using a looping strategy (e.g., lending xSTRK to borrow more STRK, and repeating the process). Vesu automates this with its Multiply feature, which:

Uses xSTRK as collateral to borrow more STRK.

Lends the borrowed STRK again to increase overall rewards (since lending APY > borrowing APR).

Note that looping strategies amplify rewards but come with additional risks.

Currently, two projects offer LST services: Endur and zkLend. Both are audited and charge 0% commission on delegations. I will focus on Endur’s LSTs here (xSTRK), as they have the most integrations within the Starknet ecosystem through platforms such as:

AVNU (swap)

Vesu (lend/borrow)

Nostra (swap + add liquidity)

Opus (lend $CASH, Starknet’s native stablecoin)

Haiko (vaults and LP).

In terms of mechanism, xSTRK operates similarly to wstETH: its value increases over time relative to STRK to reflect accumulated staking rewards. Meaning that staking rewards are auto-compounded when holding xSTRK. To convert xSTRK back to STRK, you can either swap on AVNU or unstake via Endur.Fi’s UI. In general, Endur enables faster unstaking by matching deposits with withdrawal requests, so the process can take less than 21 days, with 21 days being the maximum required.

Keep in Mind:

Liquid staking introduces an additional layer of risk compared to "normal" staking (limited, but it’s there).

To convert xSTRK to STRK, you’ll need to account for DEX trading fees and slippage, or wait for the standard 21-day unlock period (potentially less with Endur) to receive the exact amount of STRK.

Starknet Validators

Many Starknet-native projects operate validators, including:

Argent, Karnot, Braavos, AVNU, zkLend, Nimbora, Keplr, Cartridge, Pulsar Money, Pragma, Nethermind, Carbonable, and Ventory.

Commission Rates (as of March 05, 2025):

Braavos (10%)

Carbonable (2%)

Cartridge (100%)

Pragma (5%)

The rest charge 0% (meaning you keep 100% of staking rewards).

Staking with these projects is the best way to support your favorite Starknet projects. However, note that for the health of the network, staking with smaller validators helps improve decentralization.

External Validators

Several prominent external projects also run STRK validators, including:

Bitwise, one of the largest US crypto asset managers, has made Starknet the very first L2 they’ve integrated in their staking service.

Nansen, the famous and powerful multichain AI analytics platform, allows you to earn STRK staking rewards + Nansen points.

Delegation via CEX

You can also delegate directly from Bitrue, with more CEX adding support comin in the future.

Conclusion

As the first L2 to introduce permissionless staking on L2, STRK staking is a turning point for both Starknet and its users. This innovation not only adds utility to the STRK token but also reinforces Starknet’s commitment to decentralization.

For Starknet, this marks the beginning of its journey toward full decentralization, where governance, and network operations will be fully managed by its community. No other ZK Rollup has taken this path before. With a decentralized sequencer and prover network on the way, Starknet is setting the standard for trustless, scalable, and secure interactions on an L2.

For users, STRK staking unlocks new opportunities:

Earn rewards through staking yields and future protocol fees.

Leverage new DeFi strategies with liquid staking, lending, and innovative yield routes.

Interact in a fully permissionless and secure environment.

With strong participation from both validators (over 100) and delegators (over 64,000), and the integration of LSTs into the broader Starknet DeFi ecosystem, STRK staking is creating a dynamic environment that benefits both the network and its participants. From accessible staking options via wallets like Argent and Braavos to advanced opportunities with LST projects like Endur, there’s something for everyone looking to support and benefit from Starknet’s growth.

As a result, Starknet is on track to becoming a truly decentralized and secure network, staying true to the core ethos of blockchain.

Whether you’re a validator, delegator, or a DeFi farmoor leveraging LSTs, there’s no better time to get involved. So, stake your STRK (nfa), explore the ecosystem, and be part of Starknet’s journey toward becoming a fully decentralized and secure Layer 2 network.

None of the content of this newsletter is financial advice. Always do your own research.

Thank you for reading, and feel free to subscribe, it’s totally free ⏳